Exporters hit by the sharp decrease in duty drawback rates on various items following implementation of the Goods and Services Tax (GST) regime would soon get some relief as the government is finalising higher rates to compensate for embedded taxes.

“The GK Pillai committee has worked out the new structure of duty drawback which would take into account embedded taxes on inputs on which credit is not available. It will be finalised once the Finance Ministry approves it,” a government official told BusinessLine.

Duty drawback compensates exporters for the duties paid on inputs used to manufacture exported products. The higher duty drawback rates compensating for embedded taxes is likely to be announced before June 2018, when the higher rates of export incentives for labour-intensive sectors announced by the Centre on Tuesday will lapse.

Exporters allege that as the duty drawback rates do not provide for embedded taxes, their operations are coming under severe stress. Embedded taxes are levies imposed on inputs used to make products that are not taxed and, therefore, exporters cannot get a credit on them. The taxes have to be thus absorbed in the price of the item affecting its competitiveness.

“Cotton is a zero duty item. But the fertiliser, pesticides and insecticides used are taxed and that becomes part of the price because you can’t get refund on it. That is embedding,” explained Ajay Sahai from exporters body FIEO.

“The higher duty drawback rates together with timely refunds will help exporters retain their competitiveness when the higher incentives lapse,” the government official said.

The increased incentives of 2 per cent under the Merchandise Export Incentive Scheme for labour-intensive sectors announced by the Centre has come as a relief for exporters struggling under the new GST regime.

Duty drawback rates and rebate of State levies (ROSL) were revised downwards across sectors from October 1, 2017.

The textiles and garments sector was amongst the ones most affected. Drawback rate for cotton garments was dropped to 2 per cent from 7.7 per cent, for garments containing cotton and man-made fiber blends to 2.5 per cent from 9.5 per cent, and the rate on garments made of man-made fibres to 2.5 per cent from 9.8 per cent.

WTO conditions

The government also has to be careful now in giving duty drawback and ensure it is strictly according to inputs consumed as India is no more eligible to give export subsidies as per global trade rules as its per capita Gross National Income has crossed $1,000 for the third year in a row. The MEIS scheme, too, could be questioned by WTO members as it is an export subsidy and no more permitted.

Source: Business Line

The GST law may see some changes over the coming months with an expert committee proposing major amendments in the legislation and over 100 other recommendations including deferral of the E-Way Bill to 2019. The GST Law Committee is understood to have submitted its report to Finance Secretary Hasmukh Adhia and has also suggested abolishing the reverse charge mechanism and automating the refund process.

It has also called for including inter-State transactions in the composition scheme and fixing the tax rate at one per cent under the scheme for traders, manufacturers and restaurants. Significantly, it has also suggested that service providers should be included in the composition scheme, which allows for lower tax rates and quarterly return filing for small businesses.

The six-member committee led by Gautam Ray to suggest changes to the GST Act to ensure its ease of compliance. The Law Committee has also suggested simplification in GST returns, an issue that is also being looked at by another expert group. Sources said the panel received over 700 representations for changes in the new indirect tax levy that rolled in from July 1 this year.

Faster refunds

For faster refunds, it has suggested that raw materials and finished products should be taxed at the same slab. Further, exempt or nil-rated foods should not be included in the aggregate turnover. The committee is also understood to have suggested that a National Advance Ruling Authority should be set up for GST. Sources said that the report of the committee will now be examined and is expected to be discussed in the next meeting of the GST Council that is likely in January.

Source: Business Line

Former RBI governor Raghuram Rajan was keen on it. “My hope is that we will get to full capital account convertibility in a short number of years,” Rajan had said in April 2015. The hope was belied, probably for a reason.

But even if policymakers are not comfortable with the idea of full convertibility, at this juncture, they may consider making rupee convertible to the eastern regional neighbours, with whom India is eager to push trade and commerce to build a strong regional framework.

Trade in rupee

The issue keeps coming back in almost every Track-II dialogue in the region, with researchers and business, from India and the neighbouring countries, backing the proposal. The prime argument in favour is that as a dominant currency the border trade is done in Indian rupee. However, since it is illegal, the money is routed through hundi, leading to higher transaction costs.

There are two specific pitfalls to this. First, high transaction costs put hurdles before the border trade to grow to its full potential. Most importantly, the entire transaction of goods and services (which particularly dominate the border trade) remains unaccounted.

The potential is not small. Indian officials estimate that the informal trade between India and Nepal is as high as $7 billion – 75 per cent more than the official trade of $4 billion.

Sachin Chaturvedi, Director General of India’s Ministry of External Affairs-sponsored think-tank, Research and Information System for Developing countries (RIS), backs the convertibility of rupee for regional trade.

“Our calculations show that transaction costs for payment in dollar raises cost from 18 per cent to 32 per cent, based on quantum and choice of modality of payment,” said Chaturvedi at an Indo-Nepal conference at Birgunj in Nepal earlier this year.

The Nepalese Ambassador to India, senior officials of Indian mission in Nepal, and other officials and researchers from both countries, were present at the meeting.

What is true for India and Nepal is true for every country in the region. India’s official trade with Bangladesh stands at $6 billion. However, a 2010 estimate of ADB quoted the informal trade at somewhere near $6 billion.

The scene is even more complex with regard to India-Myanmar trade. Since US banks are yet to set up shop in Myanmar and India trades in dollar, transactions are routed through Singapore incurring high transaction costs.

Traders in China, Japan and Thailand do not face this problem as their currencies are convertible.

The net result is that their trade is booming and our trade is stagnant at $2 billion for years.

But that is merely the tip of the iceberg.

According to official statistics, India-Myanmar land border trade is limited to $50-70 million, and takes place only through Moreh-Tamu border. The trade is in Myanmar’s favour. However, local businesses think the informal trade is a few hundred times higher than the official border trade.

A July 2015 BusinessLine report quoted K Lalminthanga, the then president of the Mizoram Chamber of Industries, who had said that 30 per cent of the goods trade was routed through Mizoram and the balance in India’s favour.

Lalminthanga’s assumptions may not be incorrect. Earlier this year, China stopped the import of agri-commodities, including sugar, from Myanmar, through the Muse land border. The reason: many of them were from India.

Ajitava Raychaudhuri, a trade economist from Jadavpur University and expert on the regional trade issues, thinks currency convertibility may work in India’s favour. Border trade, in particular, may get the maximum boost by attracting large-scale players and the resulting reduction in trade costs.

Economic corridors

Raychaudhuri, however, adds that parallel initiative to build economic corridors will bring greater value addition to Manipur and Mizoram as they share the border with Myanmar.

Ken Tun, Chairman and CEO of Parami Energy of Yangon, thinks currency convertibility will unlock India’s potential to export pharmaceutical products and medical services to Myanmar. Parami recently started importing diesel and paraffin from Numaligarh Refinery in Assam through the land border.

“Let Indian rupee be a listed foreign exchange in the neighbourhood,” Tun said at a recent Indo-Myanmar conference in Yangon, in the presence of Indian ambassador Vikram Misri, and a galaxy of senior Myanmarese officials.

Source: Business Line

Indian policy on free trade agreements (FTAs) and, more generally, over the country’s external trade policy remains confused with India out of sync in various trade negotiations. It is unable to generate interest among members at the Regional Comprehensive Economic Partnership (RCEP) on its demand for greater market access in services. It is unable to decide on how to proceed on pending FTAs with the European Union, Australia and Canada. And at the World Trade Organisation (WTO), it continues to block other proposals (for example, multilateral rules on e-commerce), while not finding takers for its own (for example, trade facilitation agreement on services). Why is India so confused on trade and why are its positions at global and regional trade talks so much at variance with most of the rest of the world, developed and developing? The nature of India’s economic integration with the world and its mindset on imports are important reasons in this regard. As the world globalised from the 1980s onwards, production begun getting offshored, with developed economies outsourcing several key functions to developing countries. Many among the latter—such as China, Mexico, Turkey, Thailand, Ethiopia, Vietnam, Bangladesh and Cambodia—benefited by picking up labour-intensive outsourced manufacturing. These economies specialised in exporting manufactures back to countries like the US that outsourced production in the first place. India, too, benefited, but not as extensively. Limitations on expanding scale, difficulty in accessing cheap credit and lack of adequate labour with the right skills prevented India from exploiting manufacturing offshoring as much as many others.

However, the country benefited significantly from globalisation and outsourcing in another respect. It picked up the largest chunks of global outsourcing in information technology (IT), communication and financial services from developed nations. It also became one of the largest suppliers of specialists to advanced country markets as businesses in the latter invested billions in software, digital technology applications and new financial products. With globalisation easing labour mobility, Indians began moving overseas to various professions in large numbers, across a range of skills, elevating India to its current status of the largest remittance recipient in the world. This pattern of India’s economic integration has had a great influence on its vision of trade and FTAs. Many other developing countries from Asia and America, which are bigger manufacturing exporters than India, aggressively push for greater liberalisation in market access for manufacturing exports. India, while not reluctant on such access, contrasts the rest in its forceful demand for liberal market access in services, particularly movement of skilled professionals. The relative contrasts often become sources of contestation in trade negotiations between each other.

India’s relatively lesser prowess as a manufacturing exporter has also been due to the peculiar mindset that exports are good, but imports are bad. The mindset has been responsible for maintaining high tariffs on several products, including several items that are necessary for manufacturing exports. Notions of imports being ‘bad’ for the country—both as economic flows incurring foreign exchange and being injurious for prospects of domestic industry—have inhibited India’s growth as a manufacturing exporter. The first justifies perpetuation of tariffs for a fiscally strained government and the second enables domestic industry to keep lobbying for protection. Both impressions put India in a tight corner in negotiating with Asian countries, such as in RCEP, where others have lesser or zero tariffs across the entire spectrum of manufactured products given their proclivities as manufacturing exporters. This characteristic makes them far more receptive to imports compared with India. However, they are hardly as receptive when it comes to service imports, particularly labour movements from other countries. The latter step into the politically sensitive arena of immigration, where most countries, including India, are sceptical to liberal commitments given the sociocultural and security implications. It is ironical that while making India a global manufacturing powerhouse is an acceptable slogan for all political parties and industry houses, the practical necessity of a more liberal import policy for accomplishing the goal is unacceptable. Imports keep raising red flags with unfailing regularity among all the stakeholders involved in trade, making India inherently suspicious of FTAs it has signed and is negotiating.

The RCEP negotiations are hampered by the nagging fear of imports, more so because Southeast Asia, Japan and South Korea are those with whom India has FTAs, and which, arguably, have deluded the country with imports, notwithstanding evidence pointing to limited use of these FTAs. Concerns over RCEP are heightened by the presence of China, which, even without an FTA, is among the largest sources of India’s manufacturing imports. The current government is focusing hard on removing domestic infrastructure constraints. This would reduce production costs and make Indian exports more competitive. But that would take several years. And even then, imports would remain necessary for exports, as India is unlikely to become as broad-based a manufacturing economy as China, Japan, Thailand or Mexico. The government’s silence on FTAs and trade engagement is conspicuous and baffling. If the strategy is to stay away from FTAs since they enable imports, India might as well give up hopes of becoming a global manufacturing hub and manufacturing exporter in the foreseeable future.

Source: Financial Express

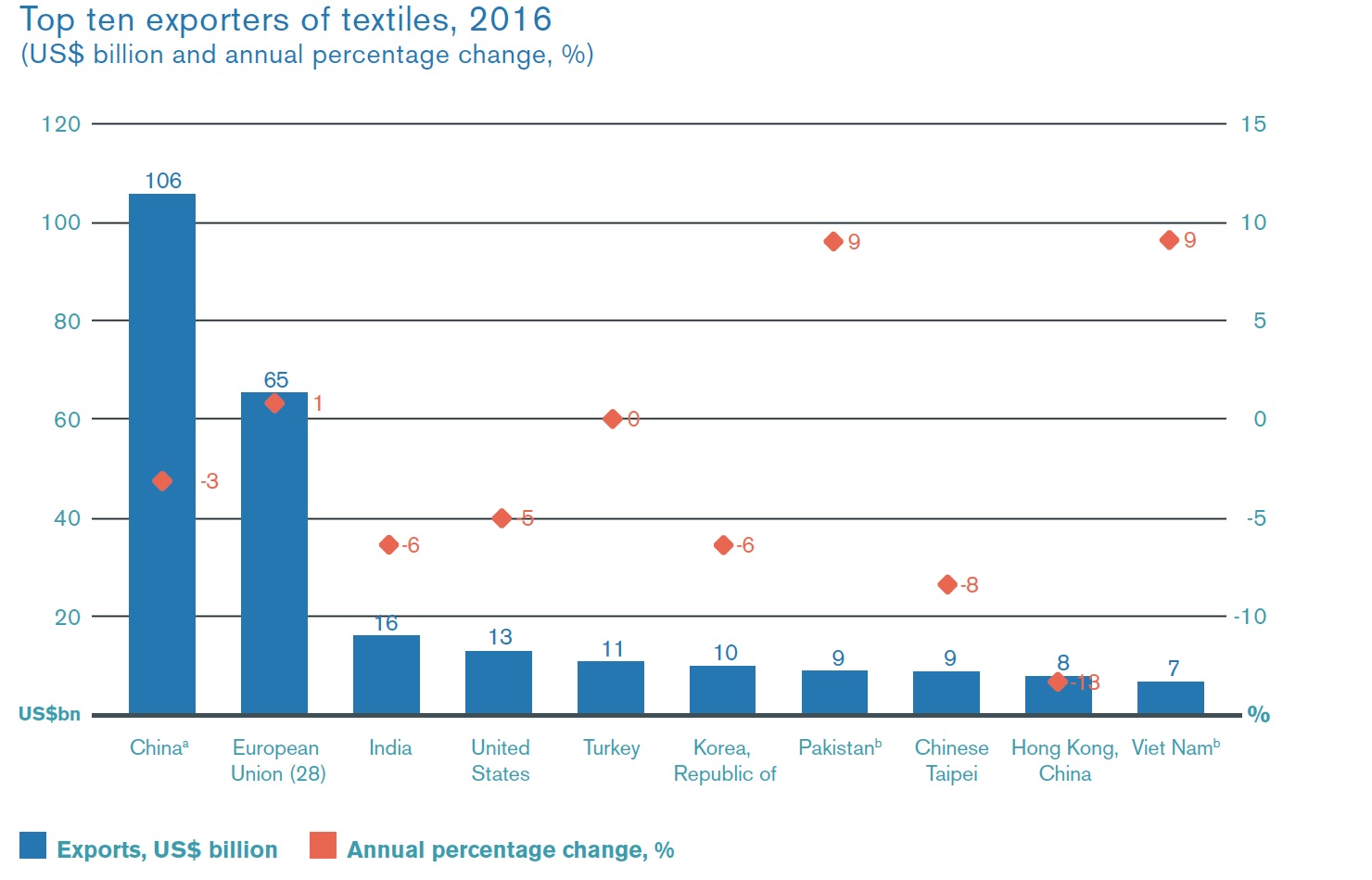

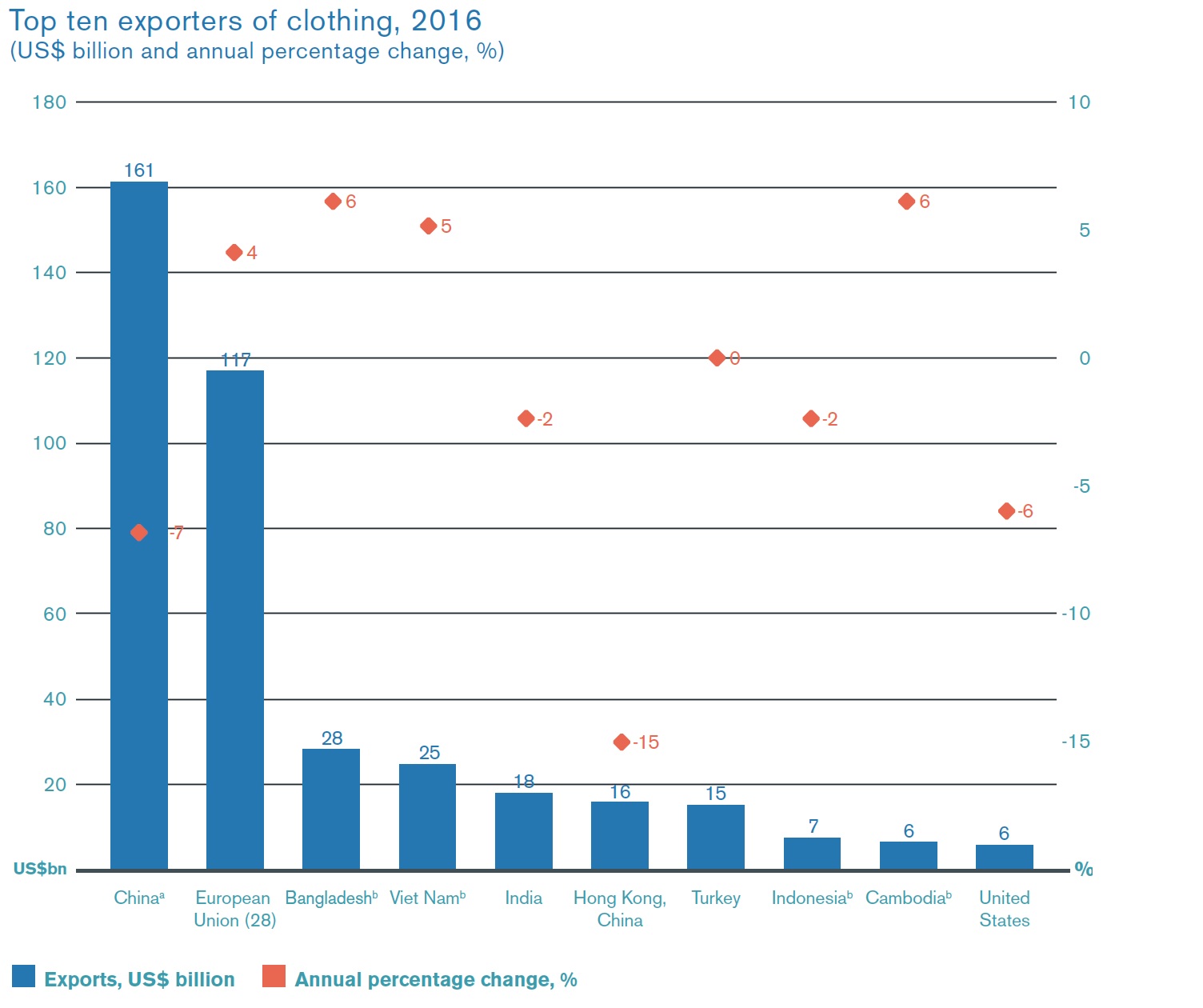

According to the newly published World Trade Statistical Review 2017 by the World Trade Organization (WTO), the current dollar value of world textiles and apparel exports by top ten countries totalled US$ 246 billion and US$ 384 billion respectively in 2016, decreasing by US$ 22 billion and US$ 3 billion respectively from a previous year.

China remained the top exporter of textiles in 2016, with a 37% share of world exports, even though its exports declined by 3%. The next biggest exporters were the EU, with a 23% share, growing by 1% in 2016, and India, with a 6% share, a decline of 6%. Pakistan rose from ninth to seventh position while Vietnam entered the top ten for the first time with a 2% share, an increase of 9%.

More than half of the top ten textiles exporters recorded a decline in the value of their exports, with the highest decline of -13% experienced by Hong Kong, followed by Taiwan (-8%), South Korea (-6%) and India (-6%), the US (-5%), and China (-3%).

The top ten exporters of clothing in 2016 remained unchanged. However, Hong Kong (China) fell from fifth to sixth position and India did the reverse, rising to fifth place. China’s exports of clothing fell by 7% but it still stayed in top position, representing 36% in value of world exports of clothing in 2016.

EU exports of clothing increased by 4% in 2016, reaching a market share of 26%. The highest increases were recorded by Cambodia and Bangladesh – 6% for both countries. Exports of China and the US fell the most, by 7% and 6% respectively.

Measured in value, the EU, the US, and China were the top three importers of textiles in 2016, accounting for 37.9% of world textile imports. The countries were followed by Vietnam, Japan, Hong Kong (China), Bangladesh, Mexico, Turkey and Indonesia.

The EU, the US, and Japan also remained the top three importers of apparel in 2016, altogether accounting for 63% of world apparel imports in 2016. Notably, China’s apparel imports have been experiencing an annual growth of 17%, much higher than most other countries, followed by South Korea at an annual growth of 12%, and Australia at 5%.

The Apparel Export Promotion Council (AEPC) and The Southern India Mills’ Association (SIMA) have welcomed the new measures announced by the Indian government in its mid-term review of Foreign Trade Policy (FTP) 2015-20. Incentives worth Rs 8,000 crore, focus on MSMEs, labour-intensive segments and agriculture sector are among the highlights of the review.

“The mid-term review of the FTP 2015-20 has made provisions which will boost trade facilitation and ease of doing business. The extension of validity of scrips from 18 months to 24 months along with the provision of zero GST on sale of scrips are surely going to help the industry in a big way,” commented AEPC chairman Ashok Rajani.

“The other initiatives like the doing away with the testing of samples for drawback purpose and the introduction of e-sealing facility for exporters will lead to quick clearances of the consignment. This will not only help in easing the port congestion but will also aid in quick movement of the cargo. However, the exporters were hoping for measures which improve market access and cost competitiveness,” he added.

The mid-term review of FTP, released by the ministry of commerce and industry, has given thrust on ease of doing business, ease of trading across borders, exploring new export markets, new export products, simplification of procedures and processes and establishing National Trade Facilitation Committee headed by Cabinet Secretary to boost exports.

SIMA chairman P Nataraj has also appreciated the formation of National Trade Facilitation Committee (NTFC) under Cabinet Secretary to focus on transparency, technology, simplification of procedures, infrastructure augmentation, etc. In a press release, he said that the 24x7 customs clearance extended to 19 sea ports and 17 air cargo complexes would help exporters.

“The Government is yet to consider the long pending demand of including cotton yarn exports under MEIS and IES schemes and also to consider fabric exports under RoSL—that are essential to utilise the highly capital and labour intensive surplus production capacities in the spinning, weaving, knitting and processing segments,” said Nataraj.

He also stated the Government could have considered the industry’s demand of GST free domestic procurement against EPCG and Advance Authorization Scheme to boost exports under mid-term review. He hoped that the Government would soon announce the enhanced duty drawback rates for all textiles taking into account all the embedded/blocked levies and enable the exporters to continue to have the level of export competitiveness that they had under pre-GST era. (RKS)

Source: Fibre2Fashion

Denim manufacturers in India, led by the New Delhi based Denim Manufacturers Association (DMA), have requested the Central government to immediately announce increased support in the form of some enhancement in present duty drawback rates and extending some more benefits under various schemes such as ROSL, MEIS, Focus Product, Focus Market, etc.

The denim fabric manufacturing industry, which used to be the sunrise industry in the entire textile value chain of India, is currently under stress and government support is needed for the industry to come out of this situation and be able to tap the potential of export market, DMA said in a press release.

At present, there are 46 denim fabric manufacturing mills operating in India, compared to 30 mills in 2012. The installed denim fabric production capacity has also increased from 800 million metres in 2012 to 1,500 million metres in 2017, making it the world’s second largest denim fabric producer, next only to China. Further, another 150 million metres of fabric production capacity expansion is in the pipeline.

As against the capacity of 1,500 million metres, the current domestic consumption is approximately 750-800 million metres, and export is 200 million metres. Thus, the industry is facing over capacity situation.

“Post introduction of the Goods and Services Tax (GST) from July 1 this year, the denim industry has temporarily closed down approx. 30-40 per cent of its capacity across the board and is currently operating at approx.. 60-70 per cent capacity due to slowdown in demand and over capacity situation in the industry,” said DMA chairman Sharad Jaipuria. “Presently, the industry is bleeding and if the situation continues, there can be more production cuts.”

Besides over capacity, the denim fabric making industry has also been paralysed because denim needs to be cut, sewn and washed before it can be marketed. These upstream activities are majorly done in the unorganised sectors located at the small-scale industry (SSI) hubs of Gandhi Nagar and Tank Road in Delhi, Ulhasnagar in Mumbai and Bellary near Bangalore. “These hubs mainly slowed down due to the liquidity crunch in the economy post demonetisation and slow acceptance of GST by small players to become part of the formal economy. As approx. 85 per cent of the fabric is sold in the domestic market, denim fabric mills are badly hit,” explained Akhilesh Rathi, director of Bhaskar Denim.

“Since the upstream activities of garment sewing and washing in SSI hubs will take a while before they change for working smoothly with the formal banking system, we do not foresee any short-term recovery of market in the near future. This has led to shutdown / slowdown of many denim mills and loss of jobs in this industry,” said Amit Dalmia of R&B Denims.

The negative impact of oversupply situation, coupled with low demand and liquidity crunch in the domestic market, has started becoming visible on the sales and profit volume of top denim mills in India in Q2 FY17-18 and similar impact looks to continue in Q3 as well, said Arpit Jain, VP-research at Arihant Capital & Brokerage.

“Considering the grave situation for denim industry, the government needs to announce some enhancement in present duty drawback rates and also extend some more benefits under ROSL scheme, MEIS scheme, Focus Product and Focus Market scheme so that denim mills can competitively tap the potential of export market and try to shift from the stress of domestic market,” said Ashima director Atul Singh. (RKS)

Source: Fibre2Fashion

(Reuters) - ICE cotton futures edged up on Wednesday, hovering near more than two-month highs hit last week on concerns over crop damage in top producer India. Cotton contracts for March CTH8 settled up 0.21 cent, or 0.29 percent, at 72.72 cents per lb., and traded in a range of 72.44 and 73.27 cents a lb.

“The bollworm problem in India is making the market bid today,” a New York-based trader said. India is likely to export nearly one-fifth less cotton than previously estimated as pink bollworms are set to eat into the south Asian country’s output which was expected to hit a record, industry officials told Reuters in late November.

“Cotton has a pretty substantial long position already ... there really are some fundamentals behind the market that continue to keep cotton with a bid,” the trader noted. Meanwhile, the market awaited export sales data from the U.S. Department of Agriculture due on Thursday.

Total futures market volume fell by 9,389 to 18,496 lots. Total open interest gained 473 to 249,201 contracts in the previous session, data showed. Certificated cotton stocks CERT-COT- STX deliverable as of Dec. 5 totalled 47,628 480-lb bales, unchanged from the previous session.

The dollar index .DXY was up 0.23 percent. The Thomson Reuters CoreCommodity CRB Index .TRJCRB, which tracks 19 commodities, was down 1.46 percent.

Source: Reuters

With pink bollworm turning virulent and posing a serious threat to the interests of farmers, the Telangana government has asked the farmers to terminate the crop before December. It has ordered an intense awareness campaign to educate the farmers to uproot the plants out after third picking

If the crop is terminated by December, it will break the lifecycle of the bollworm population, lessening the risk of the incidence in the next kharif.

The kharif season is coming to end as a good number of farmers have completed their second picking. The third picking doesn’t yield much produce but some farmers keep the crop, expecting one or two quintals.

Telangana has registered a massive increase in cotton acreage this kharif. The acreage crossed the 46-lakh acre mark, about 15 lakh acres more than the normal acreage.

Untimely rains and outbreak of pink bollworm have wreaked a havoc, causing extensive damage to small and medium farmers. But the government’s report suggest that the spread of pink bollworms is virulent and has breached the Economic Threshold Level (ETL), which could result in extensive damage.

“There is an urgent need to educate the farmers on the need to terminate the crop after December in all the cotton growing areas, particularly in Adilabad and Warangal districts,” a senior government official said.

He wanted the extension officers to convince to remove the crop and go for shredding of the stubbles. “The worms will survive in the stubbles and could transcend to the next crop,” he said.

Source: KV Kurmanath, Hindu Businessline,

THE Centre has rejected the Maharashtra government’s plea to de-notify Bt cotton in the wake of “large-scale” infestation of pink bollworm pest, and has instead advised the state to work with all stakeholders to put in place effective management strategies to check the menace. This has come out in the minutes of the “Review meeting for de-notification of Bt cotton hybrids for commercial cultivation in view of alleged breakdown of residence to pink bollworm” held under the chairmanship of Deputy Director General of Indian Council of Agricultural Research (ICAR) A K Singh in New Delhi on October 25. The minutes accessed by The Indian Express clearly states, “It was decided to continue the use of Bt cotton BGII as per existing guidelines.”

The decision was arrived at following elaborate discussions with representatives of all major cotton producing states, of which only Maharashtra had sought de- notification. Summerising the discussions, Singh said, “Proactive steps already taken by Central Institute of Cotton Research (CICR), Nagpur, for management of pink bollworm need to be implemented by all cotton growing states.” He advocated proper education, training of farmers and ginners about the Bt cotton technology. “He assured that ICAR would join hands with State government for providing technical assistance for the management of pink bollworm. There is need for collaborative efforts of all stakeholders to strengthen the transfer of technology to grassroots level,” read the minutes.

Singh’s assertion was based on experiences shared by other cotton growing states like Gujarat, Telangana, Madhya Pradesh, Andhra Pradesh, Punjab and Karnataka. At the centre of discussion was the Gujarat model of pink bollworm control as enunciated by Director of Research, Anand Agriculture University, Gujarat, K B Kathiriya who said: “Gujarat faced severe damage by pink bollworm during 2015-16. However, the state undertook mass campaigning with the help of state agricultural universities, private companies and undertook farmers’ field days and organised trainings for the ginners. As a result, this year, economic threshold level (ETL) has been crossed in very few locations.”

In integrated pest management, the economic threshold is the density of a pest at which a control treatment will provide an economic return. Kathiriya opined that there was no option to Bt cotton. I S Kategiri from Dharwad in Karnataka pitched for continuing Bt technology saying “it is effective against other bollworms (American and spotted)”. He, however, said farmers could be compensated by lowering the seed costs since “it is not effective against pink bollworm”.

Balu Naik, an official from Andhra Pradesh, said the state had laid out pink bollworm management strategies in association with the CICR. “AP has made village-level and mandal-wise plans for management. Pheromone trap (to check insect invasion) were

given 100 pc subsidy,” he said. Director of Research, Jawaharlal Nehru Krishi Vishwa Vidyalaya, Madhya Pradesh, said, “There was no issue of pink bollworm in Madhya Pradesh. Campaigning was done with the result that majority of the cotton area was below ETL.”

Telangana official T Pradeep noted that there was increased pink bollworm infestation this year but said he wa” “optimistic on managing it by cultivation of short duration hybrids, crop rotation and adoption of integrated pest management measures (IPM)”. Himachal Pradesh official S P Singh attributed the infestation to lack of refugia (the mandatory crop to be grown around Bt cotton to thwart pest attack) cultivation.

Maharashtra’s Agriculture Commissioner S P Singh, however, said, “More than 700 villages have been affected pink bollworm this year in the state. Cotton crop termination by December as recommended by CICR was not feasible as farmers were not willing to do so. Refugia seeds supplied by seed industry also didn’t conform to standards.” He called for “immediate action and technical guidance” for management of pink bollworm.

The Maharashtra government has twice written to the Centre seeking to de-notify Bt cotton due to the pink bollworm issue. Even Chief Minister Devendra Fadnavishad flagged the decreasing efficacy of Bt technology in his speech at the Agrovsion expo at Nagpur last month.

‘De-notification issue misunderstood’

Maharashtra Principal Secretary (Agriculture) Vijay Kumar said, “The denotification point made by the state has been largely misunderstood. We are not demanding discontinuation of Bt cotton. We only mean that as the technology has ceased to provide protection against pink bollworm, it should be priced at a lower level to pass on the advantage to farmers. We also agree that Bt cotton will have to continue in the

years to come.” Kumar dismissed the contention that pink bollworm infestation was due to lack of refugia plantation. Kumar said, “The companies pass on the blame to farmers but we have tested many refugia samples and found them to be substandard. Now the companies have got permission from the Centre to allow them to mix refugia seeds in the same packet as Bt seeds so that the farmers would have to use them anyway. Kumar added, “We will initiate a process under the Maharashtra Cotton Seeds (Regulation of Supply, Distribution, Sale and. Fixation of Sale Price) Act, 2009, to set up a committee to hear both farmers and the seed companies to decide about compensation to farmers by the companies, which they are liable to pay under the act.”

Source: The Indian Express, Nagpur

The textile and agri industry today said the government's mid-term review of Foreign Trade Policy (FTP) would help boost exports in labour-intensive sectors like textiles and agriculture

The textile and agri industry today said the government’s mid-term review of Foreign Trade Policy (FTP) would help boost exports in labour-intensive sectors like textiles and agriculture. (Image: Reuters)

The textile and agri industry today said the government’s mid-term review of Foreign Trade Policy (FTP) would help boost exports in labour-intensive sectors like textiles and agriculture. “The mid-term review of FTP is progressive, growth-oriented and I am glad the government has recognized the urgent need to address the challenges being faced by the exporters on account of the GST roll-out by focusing on reducing procedural burden,” the Cotton Textiles Export Promotion Council (Texprocil) chairman Ujwal Lahoti said. The revised FTP has increased MEIS rates across the board by two per cent for labour intensive sectors. Earlier the MEIS rates for garments and made-ups were increased from two per cent to four per cent. The enhanced MEIS rates will provide the much needed relief to exporters and will certainly have a positive impact on the overall exports especially of textile products, Lahoti said.

He also said the increase in the validity of duty credit scrips issued under the MEIS from 18 months to 24 months will increase the utility of such scrips. With regard to export strategy, the Texprocil chairman said it is reassuring that the revised FTP identifies markets in Africa and Latin America to be its new focus areas as part of the government’s goal of exploring new markets. The textiles sector especially technical textiles will benefit immensely from this scheme. Also, it allows domestic procurements which will promote “Make in India,” initiative, Lahoti added.

Lahoti pointed out that cotton yarn continue to be denied any benefit under the FTP. Ruchi Soya Industries managing director and CEO Dinesh Shahra said, “The increase of Rs 1,354 crore in the incentives for agriculture and related products will given an additional boost to agri industries, which will in turn benefit all stakeholders including the farmers.” It is heartening to see agro-processing as a focus area in the government’s drive to increase exports to new and un-tapped markets, and this is a big positive for the industry. We also look forward to the new agricultural exports policy to give a long-term direction to the industry through a stable policy regime, Shahra said.

Meanwhile, engineering exporters’ body EEPC India said that the RBI needs to help exporters by reducing the cost of borrowing. “The RBI could have joined the government in helping the exporters by reducing the cost of borrowing,” EEPC India chairman T S Bhasin said. The RBI policy review has taken place a day after the commerce ministry has come out with a pragmatic review of the Foreign Trade Policy. As exports are picking up due to demand pick up in some of the key markets, the domestic exporters must be strengthened to face the increasing competition from countries like China where the cost of capital is significantly lower than India, Bhasin said.

Source: Financial Express,

Over the last century, change has been a constant parameter in India; the entire nation and its people have grown from strength to strength on all frontiers. And, in Indian fashion, is there is a major that best exemplifies this essence? It is indeed the Raymond Group

Raymond’s legacy dates back almost 92 years to the year 1925, when it was a small woolen mill, by the name of Raymond Woollen Mills in Thane, that used to manufacture coarse woolen blankets and modest quantities of low-priced woolen fabrics Raymond is not a just a mere brand name in India; it’s as much a part of every Indian’s life as their pre-eminent embodiment of The Complete Man. Sure, there are other textile majors, but none come close, let alone compare, to Raymond’s ability to make a name that symbolizes trust, and then further to a brand that spans the value chain from fabrics to ready-to-wear. The brand has indeed embossed marks of unmatched credence amongst generations spanning the common man as well as the most discerning global nomad.

Raymond’s legacy dates back almost 92 years to the year 1925, when it was a small woolen mill, by the name of Raymond Woollen Mills in Thane, that used to manufacture coarse woolen blankets and modest quantities of low-priced woolen fabrics.

In 1944, Lala Kailashpat Singhania took over the mill. He set up a new manufacturing unit called JK Files in 1950 for making indigenous engineering files. Convinced that the new set up had a potential to snowball into something infinitely promising, the company concentrated on what was to become a recurring pattern in the years to follow — modernisation of machinery and infrastructure.

By 1958, Raymond became the first company to blend polyester with wool and introduced ‘Terool’. Terool turned out to be a breakthrough in the wool industry, providing a lightweight fabric that was made for cool and comfortable wear, and Raymond soon forayed into retail by opening the first exclusive retail showroom in

King’s Corner, Ballard Estate in Mumbai, the very same year. The rest, as we know is history.

The Kings of Worsted Wool

Raymond, today, is regarded as the global leader in wool. It is the world’s largest producer of worsted suiting fabrics commanding over 60 per cent market share in India. It is also among the few companies in the world, that is fully integrated to manufacture worsted fabrics, wool and wool blended fabrics. Few companies globally have such a diverse product range of nearly 20,000 varieties of worsted suiting to cater to customers across age groups, occasions and styles. The company’s suiting fabrics ranges from 80s to 250s. The company has also mastered the art of producing super fine suitings and blending polyester with specialty fibers like Cashmere, Angora, Alpaca, etc. Raymond also converts these fabrics into suits, trousers and apparels that are exported to over 55 countries in the world; including European Union, USA, Canada, Japan and Australia under the various retail brands of the company.

Not just apparel, Raymond is also the largest producer of woolen blankets in the country and offers the widest range of woolen blankets and pashmina shawls. Made from pure and regenerated wool and cashmere, these are produced in an array of colours and designs in plains, dobbies and jacquards.

Manufacturing Muscle

Raymond has always stayed ahead of the game and the way forward was through modernisation of machinery and infrastructure. In the early 60s, the company earmarked total replacement of machinery with sophisticated machinery and since then modernization has become a way of life at Raymond.

Then, in 1979, a state-of-the-art manufacturing facility was set up at Jalgaon, Maharashtra to meet the increasing demand for worsted woolen fabrics. Then in 1980, Dr. Vijaypat Singhania, an AMP alumnus from Harvard and a high flier in spirit and deed, took over the reins as the Chairman of Raymond. The Jalgaon plant was soon followed by another plant in Chhindwara that was set up in 1991. The new plant was a state-of-the-art integrated manufacturing facility located 57 kilometers from away from Nagpur. Built on 100 acres of land, the plant produces premium pure wool, wool blended and polyester viscose suiting. This plant has achieved a record production capacity of 14.65 million meters, giving it the distinction of being the single largest integrated worsted suiting unit in the world.

Subsequently, in 2006, Raymond launched the famous Vapi Plant, the world’s largest integrated composite textile mill to date. Raymond has increased its worsted suiting capacity by 14 million meters, as part of the second developmental phase of the Vapi plant. Modeled to meet international standards, the Vapi plant has been set up on 112 acres of lush green land with hi-tech machinery such as warping equipment from Switzerland, weaving machines from Belgium, finishing machines, automatic drawing-in and other machines from Italy. These three facilities together employ approximate 6,000 people and working on a combined manufacturing capacity of 38 million meters of fabric per annum.

Leading by Research and Development

The Raymond Group’s trend setting innovations can chiefly be attributed to its in-house research and development team, whose innovations have become milestones in the worsted suitings industry. Raymond holds the distinction of creating the world’s finest worsted suiting fabric from the finest wool ever produced in the world – the Super 250s fabric made of 11.4-micron wool.

“What makes it special is the fact that this fabric is made of wool that is only 11.4 micron thick (a micron is a millionth of a meter). This is approximately a fifth of the diameter of a human hair. This fibre comes from a breed of Australian Merino sheep that are renowned for their fine fleece. The quality is fare better than normal suit fabric. This is the lightest fibre with which a suit can be made. The suit fabrics of Super 250s may cost up to Rs 3 lakhs per meter,” says VP – Manufacturing, Raymond Ltd, Harish K Chatterjee.

Power House Performance

From being the first company to introduce a poly-wool blend in India to creating the world’s finest suiting fabric, the Super 250s made from the superfine 11.4-micron wool, Raymond has been a trailblazer since day-one.

Now led by Gautam Singhania, the group closed FY17 with revenues of Rs 5,509 crore registering EBIDTA margins of 7.7 per cent. 80 per cent of the Group’s business comes from domestic market which encompasses business interests ranging from textiles, fabrics, apparel manufacturing, fashion brand retailing to engineering, prophylactics and international businesses.

As of today, Raymond has retail shops selling fabrics, apparel and fashion brands. Its apparel and textiles business network have 20,000 touch points in 600 cities and towns reaching consumers through ~160 wholesalers, 3,300 MBOs, 800 large format stores and a chain of over 1,000 exclusive stores.

Source: Indiaretailing.com

New Delhi [India], Dec 6 (ANI): ASSOCHAM has suggested the government in the customary pre budget consultations with Finance Minister Arun Jaitley to reduce the Corporate Tax to 25 percent in order to encourage large investment by domestic and foreign corporates in India.

This step will be in line with countries like the US, which is also in the process of making major tax cuts, and Singapore and Middle East, which already have lower tax rates.

The apex industrial body also urged the government to consider increasing import dutyon metals like steel, aluminium, copper and zinc as high competition in the sector has adversely affected domestic metal sector.

"This sector's competitiveness is adversely affected due to high cost of electricity and other inputs and imports at zero or concessional duty rate from countries like Korea and Japan under trade agreements," ASSOCHAM said.

It also called for an urgent need to critically review the implementation process of economic reforms introduced during last one year like GST, demonetisation and Insolvency law, and take corrective steps in consultation with the industry.

ASSOCHAM also asked the government to take corrective steps for particularly the SMEsector and also the large industry segments like textiles, which have been negatively affected by complex GST compliance procedure.

"The tax refund to exporters has been considerably delayed affecting their working capital. This has reduced the export growth of sectors like leather and textile, which has huge employment potential," it added.

It urged the government to fix accountability of tax administrators as there is fear of tax terrorism prevalent in trade and industry and also to consider revising the tax exemption limits for senior citizens and salaried employees.

"Tax exemption limits for senior citizens and salaried employees should be increased who are adversely affected by inflationary impact in food items and items of daily use during recent past," the industry body also stated. (ANI)

Source: ANI

Unrebated taxes on power Will lead to increased costs and lower margins by 1-3% for several industries, eroding competitiveness and undermining Make-in-India

Unrebated taxes on power Will lead to increased costs and lower margins by 1-3% for several industries, eroding competitiveness and undermining Make-in-India

As the Goods and Services Tax (GST) overcomes the transitional implementation challenges, it is time to look ahead to further improving it. The impact of the highest rates have been reduced by substantially paring down commodities in the 28% bracket. Simplification of procedures for small enterprises, especially those that sell to large enterprises, is under way. Bringing land and real estate into the GST is on the agenda for discussion. High priority must now also be accorded to the inclusion of electricity in the GST. Why, how, and when? Currently, there is a bewildering multiplicity of electricity taxes that vary by states and across user categories, low for consumers and high for industrial users. Taxes levied by the states thus vary from 0% to 25%. It is an important source of revenue for them, amounting to about `31,000 crore for all the states combined. On average, electricity taxes account for about 3% of own tax revenues of the states, going up to close to 9% in other states. States are therefore reluctant to give up the right to levy these taxes. But the status quo imposes large costs that seriously undermine the government’s Make in India initiative.

The most serious and obvious one is that costs to industrial users of electricity are higher because they include the taxes on inputs that have gone into the supply of electricity. These include taxes on raw materials (coal, renewables) and other equipment (solar panels and batteries) . Not being part of the GST means that no input-tax credit can be claimed which results in embedding of the tax in the final price. For the textile industry, for example, these embedded taxes amount to about 2% of the price. This embedding of taxes hurts manufacturers selling to the domestic market. But they hurt in particular exporters of electricity-intensive products because they are not liable to any duty drawback—relief for taxes embedded in exports. But there is a subtler way in which these embedded taxes hurt industrial buyers of electricity, creating a double whammy for them. Electricity is finally purchased by consumers and industrial users. Politics, especially populist politics, has ensured that consumers (and other users in agriculture) pay either nothing for electricity or very little. As a result, and in order to make up for the resulting losses, discoms cross-subsidise, that is, they charge higher prices to industrial users to make up for under-charging others. But the embedding of taxes adds an extra layer of cross- subsidisation. Industrial users must also be charged higher rates to make up for the embedded taxes that cannot be recouped from consumers. Totalling up all of these effects could lead to increased costs and lower margins of between 1-3% for several industries. These margins are significant especially for exporters who face ferocious international competition and where a 1% extra cost could be fatal.

Another argument calls for its inclusion in the GST. Currently, there is a large bias in favour of renewables in GST policy. Inputs to renewables generation attract a GST rate of 5% while inputs to thermal generation attract higher rates of 18%. Supporting renewables might be conscious policy (and also good policy), but we are in a situation where subsidisation is proliferating across policy instruments, making it difficult to quantify the overall support. As we have discovered, complexity in the GST rate structure arises because it is burdened with having to meet multiple objectives. Support for renewables should be direct, conscious, and transparent. GST should not become the instrument for adding (non-transparently) to that support. If electricity were to be included in GST, then there would be no discrimination between renewables and thermal energy because all inputs going into both forms of electricity generation would receive tax credits. GST would then become neutral between different forms of

electricity generation as good tax policy should be. Thus, the case for including electricity in the GST is compelling. The question is how? Recall that including electricity in the GST would reduce or eliminate embedded taxes in electricity-using products. That means that both the central and state governments would lose revenues that would now accrue as input tax credits to the private sector. In addition, state governments would lose taxes from electricity use itself. So, there would be two sources of losses. What should be the response? Several options are available. One would be for the Centre and the states to bear the losses of the embedded taxes since the benefits would also be shared. The Centre would then compensate the states only for the direct loss of revenues. Another would be a half-way solution. This would be to impose a 5% tax on electricity in the GST—allowing inputs tax credits to flow through the GST pipeline—but then allow state governments to impose a small non-GST able cess on top of the GST rate. In this case, however, the greater the cess, the more it would resemble the status quo with all its problems as described above. So, this half-way solution must come with some limits on state governments’ freedom to levy further taxes on electricity. But in both proposals the central government would lose revenues both from the loss in embedded taxes and from having to compensate the states.

The final question relates to timing. The likelihood of fiscal losses suggests that implementation should perhaps wait till GST revenues have stabilised, say, by the end of this fiscal year. Next fiscal year would then seem the right time for action, requiring the start of discussions in the GST Council soon. In sum, there are four clear benefits from bringing electricity into the GST: reducing the costs for manufacturing; improving the competitiveness of exporters; reducing the cross-subsidisation of electricity tariffs that further undermines the competitiveness of manufacturers and exporters; and eliminating the large biases—and hence restoring neutrality of incentives—in electricity generation. There would be costs in terms of foregone revenues but the benefits would be large and states could be partially or fully compensated. Indian manufacturing is saddled with costs. Efficient GST policy should aim to reduce them.

Source: Financial Express

TIrupur Exporters’ Association (TEA) on Wednesday appealed to Union Finance Minister Arun Jaitley to address the issues like exemption from payment of IGST on imported apparel accessories, Expeditious release of refunds due to exporters.

In a pre-budget consultation meeting with Jaitley in Delhi, TEA President, Raja M Shanmugham also appealed for refund of accumulated ITC for job working units, Permanent deletion of Reverse Charge Mechanism under Section 9 (4), Fund allocation for Governmental Schemes like ATUFS (Amended Technology Upgradation Fund Scheme), ROSL( Rebate on State Levies) and Increase in fund allocation for Market Access Initiative Scheme.

In a memorandum, TEA also appealed for increase of Duty Drawback Rate to cover Blocked Central Taxes, Interest Equalization Scheme, Increase Investment Limit for MSMEs, upskilling to knitwear garment workers, formation of Knitwear Board and functioning in Tirupur, Labour Law amendment, Incentive for job creation and reduction of GST for Effluent Treatment carried out by CETPs from 18 to 5 per cent

Expressing confidence, Raja M Shanmugham said that Minister would address the issues stunting the growth of knitwear garment sector, in the forthcoming Union Budget 2018-19.

He also said that he attended the meeting called by A.K.Singh, Secretary, Ministry of Textiles and submitted the Pre Budget Memorandum, with additional points like requirement of Industry Infrastructure, State of the Art Design Studio, Knitwear Research Centre and Labour Housing and Hostels and to take up the matter and to with the minister.

Source: Covai Post Network

Despite low number of batches traded, cotton prices increased in Brazilian domestic market in November 2017, Center for Advanced Studies on Applied Economics (CEPEA) said in its latest report on cotton market. Between October 31 and November 30, the CEPEA/ESALQ Index increased 1.6 per cent, closing at 2.4475 BRL ($0.7507) per pound on November 30. Although cotton trades involved only small batches in late November, that was enough to warm up the domestic market. Representatives of processors and traders were seen trying to close new trades to replenish inventories and accomplish contracts. Several of them were already planning for the low availability of trucks during the upcoming holiday season.

Buyers, however, continued to press down quotes, and were flexible only regarding high quality batches. Sellers, on the other hand, were firm regarding asking prices, irrespective of the batch quality. As a result, several trades for short-term delivery were closed, but others were hampered due to the gap between price and quality.

Meanwhile, trading companies increased asking prices in the domestic and spot markets and for delivery in the next year, as dollar rose 1.14 per cent against real in November. Several export contracts were closed late in the month, mostly involving cotton from 2017-18 crop.

According to the Brazilian Institute of Geography and Statistics (IBGE), the industrial production of spinning mills in September 2017 dropped 1.23 per cent compared to the previous month, but increased 2.82 per cent compared to September 2016. For the clothes and accessories sector, production increased 0.85 per cent from August to September, and production increased 4.29 per cent compared to September last year. (RKS)

Source: Fibre2fashion.com

Bank credit to private sector businesses has surely galloped in the first four months of current fiscal year. The net credit off take in 4MFY18 is about Rs23 billion as against a net retirement of Rs40 billion in the year-ago period. The credit for that credit off-take, however, goes to the textile sector.

But first thing first. Credit off take in the year to- date may be higher than last year, it is much lower than the pace seen in the preceding three years. Hold on to that thought!

Now consider that manufacturing sector – that has about 58 percent share in total outstanding private sector business loans in the country – saw a net retirement of Rs1.3 billion in 4MFY18 as against a net retirement of Rs69 billion in the same period last year. This was made possible by lower retirements by food & beverages sector this year (Rs41bn vs Rs70bn), and a whopping increase in borrowings by the textile sector (Rs58bn in 4MFY18 vs Rs21bn in 4MFY17).

Together, textile and food & beverages sectors enjoy 58 percent share in manufacturing sector loans. That explains why the picture of manufacturing loans is better this year than the last. The non-food, non-textile manufacturing businesses retired a net of Rs18 billion as against Rs21 billion in the year ago period – an improvement but a modest one given the scheme of things.

With cotton prices staying largely flat between this year’s 4M period and the last, the rise in textile borrowings can be attributed to the textile package announced earlier this year. The same is visible in the cumulative monthly loan graph for the textile sector (notice that spike in October 2017).

In non-manufacturing businesses, real estate and commerce & trade have seen noticeable increases in comparison to last years’ performance. But it is really the consumer financing that demands closer attention.

Loans for housebuilding have more than doubled year-on-year. 4MFY18 saw housebuilding loans grow by Rs7.8 billion on net basis – the highest 4M number since at least FY07. Likewise, although loans for transport dipped 6 percent year -on- year in 4MFY18, it is still one of the highest 4M-credit off take numbers in the last ten years. Interestingly, loans for consumer durables have also risen sharply to Rs1.4 billion in 4MFY18 – the highest 4M disbursement in the last ten years. Although consumer durable loans are a small ticket item, it is a good proxy of consumer sentiments. With interest rates seen bottoming out, the question is whether this credit growth is strong enough to continue. If the central bank’s Bank Lending Survey (BLS) is any guide, the answer to that question is shaky.

The 1QFY18 bank lending survey based on feedback of 20 commercial bank officers suggests that overall demand for loans is expectedto increase in the ongoing quarter. However, compared to their previous survey in in 4QFY17, the numbers of bankers responding positive views about the credit conditions was about 10 points lower (on 100-point index) in the 1QFY18survey.

Whether BLS is good leading indicator or not; one will have to wait for a longer time series data before one can comment on it. But knowing that January onwards credit off-take doesn’t usually take off, that this year’s credit supply may not be better than the last.

Source: Business Recorder

Vietnamese apparel manufacturers need to embrace the opportunities to meet the growing global fast fashion trends and from which to make breakthroughs, according to experts in the field of textile and garment.

After the fever of Zara, the local market once again exploded when Swedish budget apparel retailer H&M opened its outlet in Ho Chi Minh City. Recent arrival of international brands in Vietnam has quickly received a heartened welcome from customers meanwhile they make pressure on local firms increase.

Though they are moderate and budget fashion brands, Zara, H&M and Topshop are very attractive to young Vietnamese customers . Fast fashion is the practice of rapidly translating high fashion designs into low-priced garments and accessories by mass-market retailers at low costs. As fast fashion implies, styles no longer follow a four-season fashion calendar but a weekly one.

The story that young people in Ho Chi Minh City stood in a long queue showed the fever of cheap foreign commodities. This forces Vietnamese manufacturers to rethink how to retain their customers while more arrivals of foreign fashion brands will flood in Vietnam?

Do Huu Thanh - General director of Su Tu Vang firm specializing in unifom, said that new fashion trend refers to a phenomenon in the fashion industry whereby production processes are expedited in order to get new trends to the market as quickly and cheaply as possible. As a result of this trend, enterprises will face more challenge in design, order and delivery time.

Local firms have learnt much from foreign brands including winning the market by fast introduction of design. Vietnamese firms need to have good group of designers who can grasp the rapid changing lifestyle and consumers' choice for fashion and clothing in the market to fill the order.

To meet the demand and compete with foreign counterparts, local firms must step up investment in modern equipment and attract more skilled workers.

The Vietnam Textile and Garment Association (VITAS)'s deputy general secretary Nguyen Thi Tuyet Mai said the presence of foreign brands in Vietnam has both created pressures and impetus for changes of production and business. Accordingly, customers will have more choices.

Vietnamese firms have for long been familiar with outsourcing contracts for Foreign Direct Investment companies; but now, they have to make their own products to adapt to new trends.

The Association will help update the new trend in the globe for enterprises.Saurav Ujjain, Southeast Asia business head at ThreadSol, a Singapore-based technology company in the apparel industry, presented its range of innovative solutions for Vietnam’s apparel industry such as correct purchases of fabric through intelloBuy to the most accurate planning to cut fabric through intelloCut, these solutions can help manufacturers boost revenues and profits. Averagely, IntelloCut helps producers to icnrease turnover to 30 percent with profits of $10 million each year

Source: Vietnam.net

A group of established and emerging brands are pushing the boundaries on the British high street and beyond to create timeless pieces This article titled “Feeling green: the brands bringing social consciousness into fashion” was written by Tamsin Blanchard, for theguardian.com on Wednesday 6th December 2017 14.01 UTC Eco-Age founder Livia Firth and entrepreneur Miroslava Duma were on hand this week in London to celebrate Bottletop – a fashion brand that has built a business out of making luxury handbags from waste drinks cans – now opening its first flagship store on London’s Regent Street. Bottletop is unusual, not because it makes bags out of other people’s rubbish, or that the geek-meets-chic store will have the first zero-waste interior to be 3D printed from recycled plastic complete with a resident robot making customised bag charms and key rings while you wait – although that does clock up several USPs. No, Bottletop is unusual in that it does not put its profit margins first.

The brand was started in 2002 by friends Cameron Saul, 35 and Oliver Wayman, 33, as a charitable collaboration with Mulberry (the luxury fashion house that Saul’s father, Roger, founded). The first bag was made from ring pulls and leather off-cuts in Kenya, and was sold to create employment and improve lives in under-developed communities. Their atelier is now in Salvador, where ring pulls are hand-crocheted on to certified zero-Amazon-deforestation leather and they continue to produce an art-on-canvas collection in Kenya. It feeds 20% of profits back into the Bottletop Foundation to fund health and education projects in Salvador, Rio de Janeiro, Nairobi and Ethiopia, which has amounted to around £1m so far.

Emma Watson with a Bottletop clutch at the Beauty and the Beast premiere. Photograph: PR

What is interesting is that the social enterprise element of Bottletop’s business model is what is giving it the edge over its rivals. Not being driven by profit is, in effect, good for business. A retail space on the Crown Estate’s prime Regent Street location has powerful and established brands competing for it. But, after hosting a pop-up shop in the summer, Bottletop proved they could offer a more positive message to the retail landscape than its competitors, an immersive experience where you can the broader world,” says Saul. “The product speaks for itself and performs well. People are looking for brands with those values.”

Sustainability is starting to matter in the broader world. People are looking for brands with those values. Bottletop co-founder Cameron Saul

Bottletop are pioneers in this field but their contribution of 20% towards their foundation seems small beer compared with an audacious new brand launching in January, which calls itself Ninety Percent. The clothes are what creative director Ben Matthews calls “detail driven staples”. They unveiled the collection to the fashion press last week – revealing timeless pieces you might need and will actually wear. The prices are accessible but reflective of the production costs and well-researched fabrics, which include organic cotton, and some sustainable fibres: £40 for the perfect white T-shirt; £80 for a sweatshirt.

For each Ninety Percent garment you buy, you are given a link in the garment’s label, which enables you to go online and choose one of four charities to donate your share of 90% of the brand’s profits to. The actual pieces are under wraps to the public for now – but 90% of the profits (hence the name) go to charity. But this is not a charity. It is a commercially run business based on a positive, innovative model that shares 90% of distributed profits and only retains 10% for shareholders. It is the traditional business model turned on its head.

In a crowded market Ninety Percent will be more than just a fashion brand, says Matthews who was previously buying manager at Net-a-Porter. They want to create a social movement aimed at women who want good quality, well-designed clothes but also want to know their clothes have been made with careful regard for their social and environmental impact.

The brand’s founders own Echotex, a pioneering ethical trade and LEED Platinum certified manufacturing unit in Bangladesh. They are leading the way for a new generation of manufacturers committed to sustainable practices, and ensuring that pay and conditions are at the core of what they do. Ninety Percent will sell direct to the consumer via its own website and a smart social media campaign, cutting out layers of costings that retailers’ overheads add. It’s a way of keeping prices lean without having to exploit the supply chain in the process.

When it launches, the website will tell the story behind the label, profiling employees and factory workers, allowing the customer to see who makes their clothes, as well as giving them an element of control over deciding which charities will benefit from their purchase. “I didn’t want this to be some niche brand,” says Matthews. “We want to talk to our customers.” Their hashtag is #DRESSBETTER.

Community Clothing founder and designer Patrick Grant.

It is a similar model to one being successfully utilised by the British startup Community Clothing, a collection of great-quality British basics for men and women designed by Patrick Grant and made in Britain. It is not just Bangladesh that has a problem with its treatment of garment workers. “The British clothing industry faces serious challenges. For several months of the year even the best British factories are nowhere near full. This can lead to seasonal hiring and firing, zero hours contracts, or worse – factory closures,” says Grant. “By designing with simple manufacturing in mind, these products can be sewn in the same premium fabrics and with the same quality as the best high-end designer clothes,” says Community Clothing’s Patrick Grant

Grant is an established designer in his own right, previous recipient of the British Fashion Council’s Menswear Designer of the Year award for his work on the menswear brand E.Tautz. He is the creative director of Savile Row tailor Norton & Sons – and you may know him from BBC Two’s The Great British Sewing Bee. Community Clothing is his concept, a social enterprise dedicated to making clothes, creating jobs and restoring pride in the UK textile industry.

Since Grant launched the brand in 2016, Community Clothing has generated nearly 8,000 hours of skilled labour in seven manufacturers across England and Scotland as well as six textile suppliers. It is a business model that puts the supply chain first, with design-based solutions creating a pared-back collection of classic pieces made in great quality fabrics. The Community Clothing Harrington jacket is made from 11oz of waterproofed cotton twill from the waxed-cotton specialists British Millerain in Rochdale. It sells at a reasonable £109.

Like Ninety Percent, the prices are accessible but not cheap, reflecting the hours of work and materials used as well as the retail model, which is a no-frills shop page on eBay. This keeps costs down and ensures maximum profits to go back to the workers and the suppliers. There is also a pop-up shop at Selfridges and a shop in Blackburn near the factory Grant has rescued, Cookson & Clegg, which opened in 1860 to make leather overalls for coal-delivery men.

Since the brand was launched in 2016, Community Clothing has generated nearly 8,000 hours of skilled labour in seven manufacturers across England and Scotland. Photograph: Timo Wirshing

It is like EasyJet for fashion (without the delays and with much better colour choices). The cut and quality of the garments is not compromised by the fact that it is driven by a mission to revitalise UK garment manufacture.

It is like EasyJet for fashion (without the delays and with much better colour choices). The cut and quality of the garments is not compromised by the fact that it is driven by a mission to revitalise UK garment manufacture.

“By designing with simple manufacturing in mind, these products can be sewn in the same premium fabrics and with the same quality as the best high-end designer clothes,” says Grant. “And, with our profits, we will invest in programmes in those same communities where the factories are located. We will support skills training, personal development programmes and apprenticeships that help get people into skilled work in the textile and garment industry.” Community Clothing partners with Bootstrap Company, a social enterprise dedicated to enabling people back into employment.

Community Clothing makes complete sense. It is a project Grant is passionate about and determined to grow. By giving back and generating jobs and productivity, it also generates a huge amount of goodwill within the industry. And, as with all these projects, that feel-good factor rubs off on to the clothes. And that in turn rubs off on to the wearer. This is one fashion model with a positive story to tell. The rest of the industry could do well to listen and learn.

Source: Psfk.com

She was in conversation with Ritu Sethi, Chairperson of the Crafts Revival Trust at the Good Earth store in Delhi last week, where the designer is now retailing her new collection for her avant-garde label, Sind.

Ryoko-san

Ryoko-san — as textile designer Ryoko Haraguchi is fondly addressed — started out as a designer for the Japanese retail giant Muiji. “But I soon realised that synthetic design and materials didn’t excite me,” shares the 61-year-old. She was in conversation with Ritu Sethi, Chairperson of the Crafts Revival Trust at the Good Earth store in Delhi last week, where the designer is now retailing her new collection for her avant-garde label, Sind.

Haraguchi is known for skilfully marrying Indian textiles with traditional Japanese resist dyeing techniques like Itajime (board dyeing) and Kakishibu (persimmon dyeing). In Itajime the thread is dyed using wooden boards carved with minute lines. It is then woven into patterns, with results akin to the Indian leheriya. “Only two artisans make them in Japan. Normally, this dyeing technique was used for kimonos, but I use it for fabric, which can then be used in many ways,” she adds.

Born in Kyushu, Haraguchi studied at the Otsuka Institute of Textile Design. She fell in love with Indian weaves on her maiden visit to India in 1992. “The sheer range amazed me. I was intrigued that these traditions were still alive in India, if not thriving,” says Haraguchi.

Today, Haraguchi’s label, Sind, retails Indian weaves dyed with Japanese methodology and intricacy. Her current preview collection at Good Earth includes tunics, loose fitting pants, wraps, scarves and long jackets. All of them are free-flowing, and let the dyed intricacy do the talking. “I describe my design philosophy as a blend of urban sensibilities, that which is comfortable and light, and high on the wearability quotient. Silk is often seen as something very heavy, but the way I use it, it is paper light,” she adds.

Earlier she would get the fabric dyed in Japan, but now she runs three workshops, located on the outskirts of Delhi. “I met this Kota silk weaver in Rajasthan and ordered 400 metres of fabric from him, so I could help sustain his craft. We need to buy more,” she says. She retails at Good Earth. Her creations are being exhibited at Artisans at Kala Ghoda, Mumbai, till December 10

Source: Ektaa Malik, Indian Express