The international crude oil price of Indian Basket as computed/published today by Petroleum Planning and Analysis Cell (PPAC) under the Ministry of Petroleum and Natural Gas was US$ 54.56 per barrel (bbl) on 14.09.2017. This was higher than the price of US$ 53.83 per bbl on previous publishing day of 13.09.2017.

In rupee terms, the price of Indian Basket increased to Rs. 3495.38 per bbl on 14.09.2017 as compared to Rs. 3443.89 per bbl on 13.09.2017. Rupee closed weaker at Rs. 64.07 per US$ on 14.09.2017 as compared to Rs. 63.98 per US$ on 13.09.2017. The table below gives details in this regard:

|

Particulars |

Unit |

Price on September 14, 2017 (Previous trading day i.e. 13.09.2017) |

|

Crude Oil (Indian Basket) |

($/bbl) |

54.56 (53.83) |

|

(Rs/bbl) |

3495.38 (3443.89) |

|

|

Exchange Rate |

(Rs/$) |

64.07 (63.98) |

KM/SA Daily Crude Oil Price

Mumbai, Sep 14 (PTI) The countrys technical textile market has huge growth potential and it is expected to grow at 12 per cent per annum to reach USD 23 billion (Rs 1,50,000 crore) in 2020, a senior government official said here.

"Technical textile offers immense potential and has been termed as a sunrise industry in India. With sufficient investments into the technology, the industry would grow exponentially.

"The industry is expected to to grow at 12 per cent per annum to reach USD 23 billion (Rs 1,50,000 crore) from the present USD 18.16 billion (Rs 1,16,000 crore). India comprises 4 per cent of the global technical textiles exports," Textile Commissioner Kavita Gupta told reporters on the sidelines of 7th edition of 3-day Techtextil India 2017 here.

Indias textiles sector is also one of the largest contributing sectors of Indias exports contributing 14 per cent to the countrys total exports basket. The countrys textiles market stands at USD 150 billion and it is expected to touch USD 250 billion by 2020, the commissioner said.

The textile industry employs about 51 million people directly and 68 million people indirectly as India has overtaken Italy and Germany to emerge as the worlds second largest textile exporter, Gupta said.

Technical textile is a future as it exists in every aspect of our life but this needs better productivity, better technology and better durability. In India technical textiles is expected to attract lot of investment opportunities. The government is also offering 15 per cent subsidy for domestic players, who want to set up machinery. In the last five years period the growth has been 12.4 per cent CAGR, Gupta said.

Demand for technical textiles is expected to stay steady during the period 2017-2020, due to a broadening application in end-use industries, such as automotive, construction, healthcare, and sports equipment and so on. To foster research & development in the sector the government has also set up eight Center for Excellence units, she said.

Telangana government has put in ample efforts to utilise their resources and unleash the potential in the textiles sector.

On announcing a close cooperation with Messe Frankfurt, Mihir Parekh, Department of Handlooms & Textiles, Government of Telangana said, "The Telangana state is developing Kakatiya Integrated Mega Textile Park in Warangal over an area of 1,200 acres with full complement of high quality trunk infrastructure.

"Through this partnership with Techtextil India and Messe Frankfurt India, we want to reach out to this niche sector and invite them to explore the immense growth opportunities that Telangana has to offer. We look forward to interacting with leading brands and partnering with them to create a roadmap for technical textiles in Telangana."

The Techtextil India symposium, the premier forum for the technical textiles industry hosted over 175 companies from India, Austria, Belarus, China, France, Germany, Italy, Korea, Spain, Belgium and Switzerland have exhibited their brands, garment machinery, latest innovations and product launches.

Source:PTI

The Southern India Mills’ Association (SIMA) today said there were some ill-effects due to certain GST anomalies that need to be addressed on a war footing inorder to bring all the stakeholders of the textile industry under the ambit of GST. Talking to reporters here, SIMA Chairman Nataraj appreciated the strenuous efforts taken up by the Centre while implementing the GST, by classifying the entire cotton textile value chain and also all the textile job work under the lowest and seamless GST slab of 5 per cent.

The lowest rate has protected the livelihoods of over 40 million people involved in cotton farming and trading community, Nataraj said. Stating that for processed cotton fabrics, the accumulation of input tax credit (ITC) would range between 3 to 5 per cent of the sale value, he said the dyes and chemicals account over 30 percent of the processing charge that attract 18 per cent GST while the fabric or job work is levied with 5 per cent.Yet another genuine demand of the synthetic sector was the reduction of GST rate on Man Made Fibre (MMF) spun yarn including sewing thread filament yarns from 18 to 12 per cent, he said.

The power loom sector and independent weaving units that produced over 95 per cent of the woven fabric was burdened with 18 per cent on yarn while the vertically integrated units did not have such a problem as they need to pay 18 per cent GST for fibres and only 5 per cent GST on fabrics and the cost difference works out to five to seven percent, he pointed out.

Considering this, Nataraj appealed to the GST Council to sort out both the anomalies of refunding the accumulated ITC at any stage of manufacturing especially processed fabrics and also reduce the GST on MMF spun yarn including filament sewing threads from 18 per cent to 12 per cent. Appeciating the bold and proactive initiatives taken by Prime Minister Narendra Modi and Union Textile Minister Smriti Zubin Irani, Nataraj said demonetisation and GST (one tax–one nation) were the two revolutionary policies implemented by the NDA government within a year to create a healthy business environment, curb tax evasion and corruption, enhance global cost competitiveness, and facilitate ease of doing business.

Source: Financial Express

India’s annual rate of inflation, based on monthly wholesale price index (WPI), shot up to 4-month high of 3.24 per cent for August 2017 over same month of last year. The index for ‘Manufacturing of Wearing Apparel’ group rose by 0.4 per cent to 136.5, while the index for ‘Manufacturing of Textiles’ group declined by 0.6 per cent to 112.7 in August.

The official WPI for all commodities (Base: 2011-12 = 100) for the month of August, 2017 rose by 0.8 per cent to 114.8 from 113.9 for the previous month, according to the provisional data released by the Office of the Economic Adviser, ministry of commerce and industry.

The index for manufactured products (weight 64.23 per cent) for August, 2017 rose by 0.2 per cent to 112.9 from 112.7 for the previous month. The index for textiles sub-group declined by 0.6 per cent to 112.7 from 113.4 for the previous month due to lower price of cotton yarn (2 per cent) and synthetic yarn and manufacture of other textiles (1 per cent each). However, the price of texturised and twisted yarn moved up 1 per cent.

The index for ‘Manufacture of Wearing Apparel’ sub-group rose by 0.4 per cent to 136.5 in August, 2017 from 136.0 for the previous month due to higher price of manufacture of knitted and crocheted apparel (4 per cent). However, the price of manufacture of wearing apparel (woven), except fur apparel declined 1 per cent.

The index for primary articles (weight 22.62 per cent) rose by 1.9 per cent to 134.9 from 132.4 for the previous month. On the other hand, the index for fuel and power (weight 13.15 per cent) rose by 0.9 per cent to 89.2 from 88.4 for the previous month due to higher price of naphtha, petrol, kerosene, HSD, ATF and furnace oil. However, the price of LPG and bitumen and petroleum coke declined. (RKS)

Source: Fibre2Fashion

Asahi Kasei, specialty Japanese fibre producer, is displaying its latest, unique responsible premium stretch and the new innovations by Roica Eco Smart family of stretch fibre for the modern wardrobe at the Premiere Vision show, the global event for fashion professionals, to be held from September 19 to 21, 2017, in booth 6F60 - 6G59, in Paris.

Asahi Kasei and the Roica Eco Smart family of responsible stretch innovation has now doubled its commitment to smart sustainability by receiving the Cradle-to-Cradle Innovation Institute’s Gold Level material health certificate. The Cradle-to-Cradle Innovation Institute’s Gold Level material health certificate is awarded for product ingredients that have been evaluated throughout the supply chain for impacts on human and environmental health, building towards eliminating all toxic and unidentified chemicals for a safe continuous cycle.

At Premiere Vision, Roica is also launching the new Roica Feel Good family of premium stretch that promises a new level of wellbeing performance, with ‘feel-good comfort’ and freshness. The Roica CF yarn delivers an odour-neutralising function that does not wash or wear out.

At the Paris expo, Iluna Group S.p.A will show their Iluna Green Label lace collections made with the Roica Eco Smart family, the next evolution with their new stretch galloon lace, all made with GRS certified materials.

Maglificio Ripa S.p.A., along with their new Roica CF range, are showing a range of recycled-polyamide fabrics blended with the Roica Eco Smart stretch family for a fully smart product.

Fukui Tateami Co.,Ltd., a leading hi-tech knitted fabric producer for outer wear, have partnered with Asahi Kasei making state-of-the-art textiles with Roica for the European and USA markets, now offering responsible solutions using the Roica Eco-Smart family of premium stretch.

V&A Japan Corporation, a leading textile manufacturer, is using Roica Eco-Smart family to develop new textile for the light-middle weight woven fabric for the outerwear market. With the key sustainable values of Roica, Première Vision has selected V&A to be a smart ambassador within the project ‘Smart Creation’. Smart Creation is a way of bringing together and communicating the initiatives and the means towards responsible creation, innovation and production.

Key developments in Roica Eco Smart will be displayed in the Smart Library, located on the Smart Square, hall 3 of Première Vision. The first Cradle2Cradle certified lingerie set and tights by Wolford, made with Roica Eco Smart family, have also been selected as responsibly developed item for the Smart Wardrobe. (GK)

Source: Fibre2Fashion

The Delhi High Court has allowed a private company to import goods to manufacture products for export, without paying the additional levy of the latest Integrated Goods and Services Tax.

A bench of Justices S Muralidhar and Pratibha M Singh, in an interim direction, permitted the petitioner Narendra Plastic Private Ltd to import goods constituting inputs for the fulfilment of its exportorders placed before July 1, without paying the additional levy of IGST.

“Export orders are usually placed several months in advance and the price fixed is not variable beyond a point. If an additional levy is imposed, after the acceptance of such export orders, the resultant burden cannot possibly be passed on by the exporter to the buyers outside India”, the bench said.

“This might lead to the cancellation of such export orders placing the exporter in a piquant situation,” the bench observed.

The company, which is into manufacturing and export of plastic products, had moved the court against a notification issued under the recent GST regime that levies an additional tax on imports made after July 1 this year.

The company claimed that it holds export orders placed prior to July 1, for the fulfilment of which it has to undertake imports of inputs.

As per the Advance Authorisation Scheme (AAS) under the Foreign Trade Policy 2015-2020, exporter manufacturers were entitled to duty-free import of inputs which are physically incorporated in the export product.

“The working of the AAS is such that, for the import of inputs made by exporter towards fulfilment of export orders, the credit of customs duty, as specified in the Advance Authorisation licenses issued to the exporter, is permitted to be availed of at the time of import,” the court observed.

It said that the company will be “permitted to clear the consignments of imports constituting inputs for the fulfilment of its export orders placed on it prior to July 1, 2017 without any additional levies, and subject to the quantity and value as specified in the advance authorisation licenses issued to it prior to July 1, 2017.”

The order said that interim direction is “further subject to the petitioner furnishing an undertaking by way of an affidavit filed in this court within one week to the effect that in the case of the petitioner ultimately not succeeding in this writ petition, or failing to fulfil its export obligations, it is liable to pay the entire IGST as was leviable, together with whatever interest as the court may determine at the time of final disposal of the petition.”

Source: PTI

The second half of September could be a crucial period for the textile industry as the government is yet to give a mandate to the duty drawback committee on the revised duty drawback rate and Rebate of State Levies (ROSL) on export of garments and made-up textile articles.

The government had extended this benefit up to the end of this month. “As only a fortnight is left, uncertainty persists in the rates of benefits and export bookings are getting delayed. We are unable to book orders due to lack of clarity on the duty drawback rate, and this could impact India’s textile exports,” said P Nataraj, Chairman, the Southern India Mills Association (SIMA).

Export benefits

He has appealed to expedite clearing of all pending export benefits as it is causing severe financial stress to the exporters.

“We hail the government’s intervention — be it demonetisation or GST — but the fact remains that the businesses have been affected the past two-three months. The industry has just started to overcome the difficulties. Supply of fabric and yarn is tending to look up as festive season is round the corner. At such a time, if the issues are taken up on a war-footing, it would lead to more misery, troubles,” he said.

Highlighting some of the major problems and ill-effects due to certain GST anomalies, Nataraj voiced concern over the undue delay in getting clarifications including use of C forms for inter-state purchase of HSD oil under 2 per cent CST (as petroleum products have been kept out of GST), and issues relating to canteen and transport services provided by the manufacturing units to their employees through contractors or at concessional rate. “The local tax authorities only forward the issues to the GST Council for clarification instead of providing instant service then and there.”

The association has appealed for refund of the accumulated input tax credit at the fabric stage (as fabric has been singled out, cannot take Input Tax Credit) to avoid cost escalation.

The decentralised weaving sector believed that the fabric would be exempt from GST and suspended the purchases. The powerloom sector and the independent weaving units that produce over 95 per cent of the woven fabric is burdened with 18 per cent GST on yarn, while the vertically integrated units have no such problem as they need to pay 18 per cent GST for fibres and 5 per cent GST on fabrics. (The cost difference works out to 5 to 7 per cent).

The SIMA chief has appealed to the GST Council to sort out the anomalies of refunding the accumulated Input Tax Credit at any stage of the manufacturing process, especially processed fabrics and reduce the GST on MMF spun yarn (including filament sewing threads) from 18 per cent to 12 per cent.

Source: Business Line

COIMBATORE: The next fortnight is likely to be crucial for the textile industry as the ambiguity over duty drawbacks continues. Currently, the duty drawback benefits are available only till September 30. The industry has appealed to the Centre to continue all export benefits till the business revives and returns to normalcy. Industrialists also said that retaining drawbacks and refunding input tax credits were critical in keeping production costs low and for Indian products to remain globally competitive.

Speaking to the media, chairman of The Southern India Mills' Association (SIMA) and managing director, KPR Group, P Natraj, said the government had not yet given the mandate to the duty drawback committee to recommend the revised duty draw back rates.

"With the ambiguity and uncertainty over duty drawbacks continuing, people are hesitating to take export bookings at the current rate, because the booking orders are likely to be delivered only after two months when a new drawback rate could be in place," said Natraj. "We appeal to the Centre to extend all export benefits till the industry revives and ensure that pre GST export competitiveness is retained," he said.

Industrialists also said that they required more clarity regarding GST Act and rules and the local authorities are often not able to provide immediate answers. "The local tax authorities should be facilitated to clarify the industry then and there, but now they only forward the issues and clarification to the concerned GST Council Committees," said Natraj."For example, regarding purchase of HSD oil under 2% CST and the use of C form is creating confusions, because Kerala accepts them but Tamil Nadu does not," he said.

SIMA also appealed to the GST council to reduce the tax on man-made fibres, including sewing thread filament yarns, from 18% to 12%. "The powerloom sector which uses yarn, pays 18% GST on buying yarn but they get to charge only 5% GST on fabrics, so they are unable to take out the input credit on it. The cost difference works out 5% to 7%," he said.

Source: Times of INDIA

Prime Minister Narendra Modi and his Japanese counterpart Shinzo Abe on Thursday laid the foundation of India’s first high speed rail project, linking country’s commercial capital Mumbai to Ahmedabad, the main city in Modi’s home state Gujarat.

The two countries also inked 15 agreements, including one to give a fillip to India’s Act East policy by enhancing connectivity and developmental projects in India’s northeast, and for more flights between the two countries.

Modi and Abe addressed the India-Japan Business Plenary held at the town’s Mahatma Mandir centre.

This was the fourth summit meeting between Modi and Abe. The two leaders visited the Sabarmati Ashram on Wednesday after Abe’s arrival in Gujarat in the afternoon. The Japanese Prime Minister was on a two-day visit to Gujarat.

Source: Hindustan Times

The finance ministry has ruled out excise duty cuts in petrol and diesel, given the Centre's need for money, despite rising retail prices of fuels. “We are not even thinking about it. The finances do not allow us to cut the rates,” a senior ministry official said.

The government also took refuge in the fact that global crude prices have stabilised. “(Global) prices have stabilised and will soften in the coming days. With daily price revision in place, it will be immediately passed on to the consumers,” Petroleum Minister Dharmendra Pradhan said in a tweet.

Over half of total excise duty collection comes from petrol and diesel. The Centre’s fiscal deficit touched 92 per cent of the full-year Budget estimate after the first four months of the financial year, compared to 74 per cent in the same period last year. This was mainly due to front-loading of expenditure.

State Bank of India group Chief Economist Soumya Kanti Ghosh said a one per cent cut in excise duties on petrol and diesel would affect the Centre’s revenue by Rs 13,000-15,000 crore. This means up to 2.7 per cent of the budgeted fiscal deficit, at Rs 5.46 lakh crore. At a time when the target of reining in the deficit at the aimed 3.2 per cent of gross domestic product (GDP) is already a challenge.

Expenditure could be cut to meet this target but that could affect the GDP growth rate. Which, at 5.7 per cent in the first quarter of 2017-18 is already the lowest in the three years of the Modi government. And, if this growth rate falls, achieving the 3.2 per cent deficit target would become more difficult, Ghosh said.

Also, say experts, there is uncertainty over various revenue receipts. Aditi Nayar, the principal economist with rating agency ICRA, said, “In addition to the lower surplus being transferred by the Reserve Bank of India, there remains likely that the eventual inflows from disinvestment and telecom might be lower than the budgeted target.”

There is also, she said, lack of clarity at present regarding the buoyancy in the collection from the new goods and services tax this year. Till the monthly flow from this stabilises, she felt, the government might not be inclined to reduce excise duty on fuels.

Devendra Pant, chief economist with India Ratings, said even as petroleum had become costlier, the headline inflation numbers were under control due to less pressure from other items.

This might allow the government to retain the rates of excise duty on petroleum. If headline inflation exceeded four per cent, the government might think of these steps, he said. Consumer Price Index inflation rose to a five-month high of 3.36 per cent in August, from 2.36 per cent in July.

Source: Business Standard

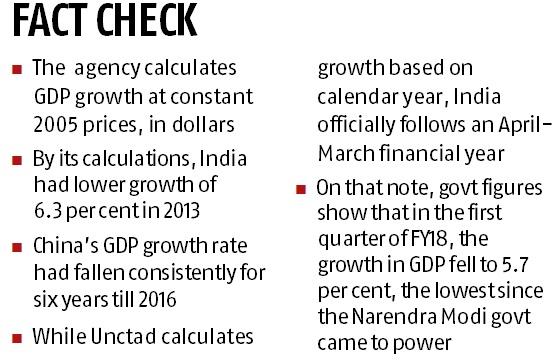

After racing past China for two years, India's Gross Domestic Product (GDP) growth in 2017 is expected to return to the same level as its northern neighbour at 6.7 per cent, according to a United Nations body.

A report published on Thursday by the UN Conference on Trade and Development (Unctad) forecasts 6.7 per cent growth in 2017, a four-year low, down from seven per cent last year.

The agency calculates GDP growth at constant 2005 prices, in dollars. By its calculations, we had lower growth of 6.3 per cent in 2013. China's GDP growth rate had fallen consistently for six years till 2016, from when it is expected to stabilise.

While Unctad calculates growth based on calendar year, India officially follows the financial year format comprising the April-March period.

On that note, government figures show that in the first quarter (April-June) of FY18, the growth in GDP fell to 5.7 per cent, the lowest since the Narendra Modi government came to power in 2014. Experts say this was largely a fallout of the scrapping of Rs 500 and Rs 1,000 notes in November 2016, which had led to massive fall in demand.

Overall growth of world economy is estimated to stand at 2.6 per cent in 2017, marginally more than the 2.2 per cent in 2016 and the same level in 2015. This is because of the continued low growth in Japan, the United States and core euro zone economies, apart from a simultaneous slow down in Britain as well, Unctad believes.

On South and Southeast Asia, the report says the export-led growth strategy of nations in the region are coming under severe strain, with continuing weakness in external demand, volatile capital flows and tightening of global financial conditions.

These economies, including India, are unlikely to see growth rates return to pre-2008 levels, or the time when the global crisis had set in, any time soon.

Exports have continued to remain low for cyclical and structural reasons, the report said.

Merchandise export growth slowed to 3.94 per cent in July, even as India witnessed 11 straight months of rise in outbound trade.

The rate of growth has continuously declined since March, when it hit a high of 27 per cent- the steepest in a little over five years.

The gradual slowdown in China is expected to continue as it rebalances its economy towards domestic markets. However, the explosion of domestic debt there since the 2008 crisis has acted as a major hurdle, thereby, impeding sustained growth.

Grappling with a similar issue, India's struggle in dealing with an exploding rise in stressed and non-performing assets (NPAs) entrenched in the banking system has been flagged by the report.

"Data for all banks (public and private), relating to December 2016, point to a 59.3 per cent increase over the previous 12 months, taking it to 9.3 per cent of their advances, compared with a non-performing assets to advances ratio of 3.5 per cent at the end of 2012," the report mentioned.

Unctad has suggested a significant and coordinated break with fiscal caution, along with austerity in major economies to break out of the current low growth cycle.

Source: Business Standard

With a slew of reported glitches in the Goods and Services Tax Network (GSTN, the ministerial panel on the subject will meet on Saturday in Bengaluru to examine the information technology (IT) challenges plaguing the uniform tax regime.

The committee, chaired by Sushil Modi, deputy chief minister and finance minister of Bihar, was constituted earlier this week. It was a sequel to the GST Council's decision last week at Hyderabad, to oversee technical and operational issues pertaining to the IT infrastructure.

GSTN will give a presentation to the ministers of the work done, challenges and the strategy. The meeting will be attended by its officials and those of IT major Infosys.

"We will try to understand the IT infra issue from a 360-degree perspective. We will review the issues faced by traders and the challenges confronting GSTN. A strategy will be charted after the meeting," said a state finance minister, part of the five-member panel. New GSTN chairman A B Pandey will attend, as will its chief executive, Prakash Kumar.

The committee was constituted in the wake of complaints from businesses about the glitches in GSTN. Simultaneously, the timeline for filing of returns was extended. The system had crashed last Friday, September 8, two days before the earlier deadline to file detailed sales returns, after a flood of entities tried uploading of invoices. Close to 750,000 returns were filed on Saturday, just before the due date was extended to October 10.

Officials in the government argue that businesses deferring return filing till the last day is also a factor for the panic. "After the announcement of deadline extension, hardly anyone is filing their returns. People have stopped coming now. This mentality needs to change," said one.

Acknowledging the issue with the system, a finance ministry official said, "Once you start a large system, there will be issues. Forms were finalised in the last week and then there were modifications. Keeping that in mind, GSTN is a stable system but, unfortunately, the system didn't work on September 8."

The officials say too many forms, such as GSTR 3B, were introduced at the last minute. "GSTN is trying to do so many things at the same time. Officials are working till four in the morning in trying to fix issues," said one.

About 2.8 million GSTR-1 or detailed sales returns were filed by Saturday, the earlier deadline. This is about half the expected returns for the month of July. However, traffic on the GSTN portal on Saturday declined significantly from 80,000 users an hour to 17,000 an hour after finance minister Arun Jaitley announced the extension.

The deadline for filing of purchase returns or GSTR-2 and GSTR-3, the matching ones of GSTR-1 and GSTR-2 for July, have also been extended to October 31 and November 10, from September 25 and September 30, respectively. Jaitley had said the decision was taken after the portal got overloaded more than once.

"The extension will give time for taxpayers to get familiarised with the software. The software companies are still not ready. Most taxpayers are using our offline tool and not coming through the GST Suvidha Providers," said a GSTN official. Only 13 per cent of the returns filed so far are through the Suvidha Providers (GSPs). "These GSPs have all application programming interfaces (APIs) provided through them; yet, the numbers filing through them is so low," said a GSTN official.

Traders have been reporting issues related to invoice matching, claiming of transition credits via the Tran1 form, errors in making final submissions, uploading of returns and of invoices, among others.

The summarised return filing, GSTR-3B, earlier for a limited period of two months, July and August, has been extended to another four months, till December. About 77.7 per cent of the summarised returns have been filed for July. Punjab has filed 92.5 per cent of the expected summarised returns; West Bengal and Delhi have filed a little over 85 per cent. "It is happening on the same server and not in thin air," argued another official.

For GSTR-1, Punjab has filed 70 per cent of the expected returns for July.

Pratik Jain of consultants PwC India said the situation had improved but businesses were still facing difficulties. "At times, there is substantial delay in processing. Similarly, the utility for filing TRAN-2 (for claiming deemed credit) is still unavailable. The extension is a breather for companies struggling to file returns," he added.

"Filing peaks on the last few days. It is a new law, new technology, and people are taking time to understand. The extension given by the GST Council will help GSTN to ramp up its system and businesses to understand the issue. Businesses have multiple queries, such as how to report information under different sections of the GST returns, how to file for input tax credit, etc," said Archit Gupta, chief executive officer (CEO) at ClearTax.

"There are a lot of concerns and apprehensions among business owners as they make a switch to the GST system of filing," says Saket Aggarwal, global CEO, Spice Digital.

Source: Business Standard

Mumbai, Sep 14 (PTI) After a brief overnight pause, the rupee was again caught in a downward spiral and slipped by 12 paise to 64.12 against the US dollar today on fresh demand for the American currency from banks and importers amid persistent foreign capital outflows.

Foreign portfolio investors sold shares worth a net Rs 826.77 crore, provisional data of stocks exchanges showed.

The domestic currency started on a negative note at 64.17 against the Wednesday's closing level of 64 at the forex market before concluding at 64.12 a dollar, a loss of 12 paise or 0.19 per cent.

The rupee had ended 4 paise higher yesterday.

The Indian currency today hovered in a range of 64.18 and 64.06 per dollar.

Meanwhile, the Reserve Bank fixed the reference rate for the US dollar at 64.0692 and for the euro at 76.1398.

On the domestic bourses, the BSE benchmark Sensex moved up by 55.52 points, or 0.17 per cent, to close at 32,241.93, while the NSE Nifty rose marginally by 7 points.

The dollar index, which measures the greenback's value against a basket of 6 global currencies, dropped by 0.09 per cent in the late afternoon trade.

The American unit consolidated its gains today, a day after posting its biggest single-day rise in six weeks as markets looked forward to US inflation data which will determine the near-term outlook for the struggling dollar.

With short bets against the dollar stuck near record highs despite this week's rally, any upside inflation surprise might trigger a broad-based pull-back in positioning.

In cross-currency trades, the rupee ended lower against the pound sterling at 85.40 per pound as against the previous closing of 84.94 but rose against the euro to end at 76.18 from 76.69.

The domestic unit firmed up further against the Japanese yen to settle at 57.96 per 100 yens from 58.16 per yesterday.

In forward market today, the premium for dollar eased further on sustained receivings from exporters.

The benchmark six-month premium payable in February eased further to 121.75-123.75 paise from 125-127 paise yeterday, while the far-forward August 2018 contract also fell to 262- 264 paise from 266-268 paise.

Source: PTI

The textile and automobile sectors in Egypt will attract Chinese investment to exploit the former’s cheap labour, Egyptian minister of trade and industry Tarek Qabil has said. Qabil said this after meeting São Gishang, president of the China Chamber of Commerce for Import and Export of Textiles, during his visit to China recently to discuss cooperation.

Chinese company Shandong Rui recently announced its plan to invest $800 million to construct a readymade garments factory in Egypt, an Egyptian newspaper reported.

Chinese firms are at present looking for manufacturing cars inside Egypt to overcome high customs duties, which is 40 per cent for imported cars from China, compared to low duties on cars from the European Union, Turkey and Morocco, Qabil told the newspaper.

Former chairman of Supreme Textile Council Mohammed Qasem said that higher minimum wages of Chinese workers will encourage Chinese textile companies to invest in Egypt.

Egypt is an optimal choice for China to set up a hub for manufacturing cars and export them to other African nations, Qabil added, as the industry ministry offers huge incentives to attract investments for car manufacturing.

A joint committee was set up in 2016 by the Egyptian Government to improve production capabilities between the two countries and set a plan for constructing 12 projects in electricity, transport, housing, industry and telecommunications. (DS)

Fibre2Fashion

More than 320,000 tons of Cotton made in Africa (CmiA) certified cotton were harvested in 2016 and processed further by textile producers in Asia, Europe and Africa. An increase has been observed in the number of fashion brands and textile retailers purchasing cotton from CmiA, the largest label for sustainable cotton from Africa, for their textiles.

Nearly 30 companies and brands use CmiA cotton for their textiles. The top customers of 2016 include the Otto Group, with bonprix as the biggest buyer within the company group, Tchibo and the Rewe Group with its sales channels Rewe, Penny and Toom Baumarkt. Additionally, Engelbert Strauss, Ernsting’s family, Asos, Aldi Süd and Bestseller rank among the biggest buyers that support the initiative through their demand for CmiA cotton. Smaller fashion labels such as Hiitu from Germany, Cooekid from Great Britain, Weaverbirds from Denmark or Abaana from Uganda are also contributing significantly by purchasing CmiA cotton. They offer an exclusive selection of products made from Cotton made in Africa cotton, ranging from children's clothing to high fashion textiles.

"In view of the many heterogeneous buyers of Cotton made in Africa cotton, it is clear that sustainable cotton from Africa can be used for a number of different product groups," Christian Barthel, director supply chain management said. "Sustainable cotton can be used for a very wide basis in the textile industry. Our partners successfully show that Cotton made in Africa cotton can lay a sustainable foundation for many branches."

CmiA cotton is grown by more than 780,000 smallholder farmers in 10 countries of sub-Saharan Africa and in accordance with the ecological and socio-economic criteria of the CmiA standard. More than 100 partners in the textile value chain are working with CmiA across the globe, to implement the principle of helping people to help themselves through trade. (RR)

Source: Fibre2Fashion

The fast fashion industry is the second-dirtiest in the world after oil. One of the key ways to make it more sustainable and something close to circular, is the recycling of textile blends.

H&M Foundation, the Swedish clothing giant’s independent charitable foundation and investment company, has now announced breakthrough solution in this realm together with Hong Kong Research Institute of Textiles.

H&M Foundation had tasked the Hong Kong-based research institute with finding at least one open source solution for textile blend recycling that could be commercially viable by 2020. Merely one year into the project, there seems to have been a decisive breakthrough:

“The institute has found a way to recycle fibres of sufficient quality from polyester and cotton,” says Erik Bang, Innovation Lead at H&M Foundation after returning from Hong Kong, where he presented the findings during Hong Kong Fashion Summit.

Bang points out that a viable textile blend recycling technology has so far eluded the industry. "Until now, the quality [of blended materials] has been too poor to be used in new textiles."

The breakthrough concerns a hydrothermal, or chemical, process, which uses only heat, water and less than 5% biodegradable agent, to self-separate cotton and polyester blends. H&M Foundation says the recycled polyester- and cotton fibres are sufficient for use in new textile production.

The discovery has happened by collecting available information on the 15 or so projects – both in academia and industry – that are leading the way in research into textile blend recycling. These findings have then been tested, iterated and developed further in the institute’s own laboratory.

“For instance, we’ve found our own bacteria and chemicals, and we’ve done tests on heat and pressure.”

Ultimately, two technologies stood out: hydrothermal and biological recycling. The former then gained the researchers’ favor, although the biological method also showed promise.

The next step in the project will be to build an industrial scale pilot plant in connection with the Hong Kong institute. The H&M Foundation hopes the technology will be commercialized and available to the entire fashion industry by 2020.

H&M Foundation supports technologies centered on water, textiles and land use to find solutions for a sustainable fashion industry. In total, H&M foundation has earmarked 6 million for the Hong Kong project, with an additional 24 million coming from the Hong Kong government.

“As far as we are concerned, this is the most substantial initiative to solve the holy grail of textile recycling."

Today, recycling is mostly done mechanically, where materials are churned and cut down. The method doesn’t really work with blended materials, as it results in such poor quality textile that it needs to be blended with new material in order to be eligible for production.

“Blended materials make up the vast majority of all textiles today, for reasons relating to price, comfort and design. We are not seeing any signs indicating that its use will go down. Quite the opposite."

Erik Bang doesn’t believe there is a “silver bullet” for creating a sustainable fashion industry. He thinks the textile recycling plants of the future will run on various different technologies that complement each other.

Whether his team's innovation is one of them, depends on a successful commercialization.

Source: Business Insider

Intertextile Shanghai Apparel Fabrics, China’s international trade fair for apparel fabrics and accessories, to be held in October will focus on sustainability. The centre of sustainability is the All About Sustainability zone, but eco-friendly products and companies will also be part of Beyond Denim, Functional Lab, SalonEurope and Accessories Vision areas. The show is to be held during October 11-13, 2017.

In Beyond Denim zone, Orta Anadolu, Kipas Denim and Soorty Enterprises will all introduce their own eco-friendly denim production processes. And in the Functional Lab, many exhibitors offer both innovative and sustainable products such as the Chemours Company’s durable water repellent which contains 63 per cent renewably sourced content, and Singtex with their insulation foam and membrane made from coffee oil extracted from used coffee grounds – just two of the many sustainable products on offer.

Buyers will be spoilt for choice with the number of new products and technologies on offer in the All About Sustainability area. One such example is the new Recycolor-branded, GRS-certified recycled cotton developed by Japanese firm Yagi & Co, a manufacturer of recycled cotton yarn, knitting and weaving fabrics and denim products. Recycolor cotton is made from old clothing and scraps from garment factories, which are sorted by colour and fed into stripping machines that break the fabric down into their original fibres. As these fibres are usually too short to spin, they are then mixed with virgin cotton and undergo a special spinning technique to create a yarn up to commercial standards.

New to the fair this edition is Chinese company Newtech Textile, who will showcase their patented Cooltrans transfer printing and dyeing technology, an eco-friendly alternative to digital inkjet printing. Compared to conventional printing technologies, Cooltrans reduces water and dye consumption by 40 per cent and 67 per cent respectively, while 92 per cent of water can be reused. It also reduces energy usage by up to 65 per cent, thanks to a cooler transfer temperature, and features rates of 95 per cent for dye transfer and 95 per cent for dye-fixing. In addition to the environmental aspects of the technology, it also offers higher colour yields and more delicate printing on the transfer paper or file than direct textile inkjet printing.

Returning to the fair again in All About Sustainability is the Oeko-Tex by Testex Pavilion, which will feature 10 STANDARD 100 by Oeko-Tex-certified companies and customers of Testex. The pavilion’s product range includes knitted and woven fabrics made of natural fibres, chemical fibres, and mixed and microfibre functional fabrics, as well as accessories such as embroidery thread, labels, RFID tags and more. Included in the pavilion is new member Sateri, a global leader in viscose rayon, as well as Malaysia’s Penfabric, a member of the Toray Group, which is also STeP certified, while its semi-finished products are Made in Green by Oeko-Tex -labelled. Furthermore, the Made In Green / STeP by Oeko-Tex Shop will feature 17 STeP-certified companies showcasing their textiles made in environmentally friendly facilities and safe and socially responsible workplaces.

Featuring for the first time in All About Sustainability is the ECOCERT Pavilion, organised by this inspection and certification body for organic agricultural products. Two of the members of the pavilion include Shaoxing ECOU Textile which specialises in organic cotton and linen, bamboo, Tencel, Modal and hemp fabrics, while Chifeng Dongrong Cashmere Development will showcase a wide range of sustainable cashmere products.

Sustainable Fashion Educator Pack developed by Redress, a Hong Kong based environmental NGO which provides tools and resources to enable educators to introduce the topics of a garment’s lifecycle, zero-waste, up-cycling and reconstruction to fashion students and the industry, will be introduced by Redress founder Christina Dean in two sessions held during the fair.

There will also be three panel discussions on Sustainable Fast Fashion, Sustainable Denim, and Organic Cotton Trends and Certification at the show. (SV)

Source: Fibre2Fashion

MUMBAI (Reuters) - The world’s top cotton buyers, all in Asia, are flocking to India to secure supplies after fierce storms in the United States, the biggest exporter of the fibre, affected the size and quality of the crop, dealers said.

In the past week alone, India, the world’s second-biggest cotton exporter, sealed deals to sell about a million bales to China, Taiwan, Vietnam, Pakistan, Bangladesh and Indonesia - key garment suppliers to brands such as H&M, Inditex-owned Zara and Wal-Mart Stores Inc.

That compared with 300,000 bales in the two weeks before.

Dealers expect contracts similar to last week in the next few months, which could help India’s exports grow by a quarter in the 2017/18 season beginning October.

“Indian cotton has great chances this year,” said Chirag Patel, chief executive at Jaydeep Cotton Fibers Pvt Ltd, a leading exporter. Asian “buyers are switching to Indian cotton from the U.S.”

Hurricanes Harvey and Irma caused widespread damage to the crop in Texas and Georgia, major cotton producing states, with the effects more widespread in Texas, dealers said.

”We definitely lost cotton in Texas. It wiped out 500,000-600,000 bales,” said Peter Egli, risk manager at Plexus Cotton Ltd, a Chicago-based merchant, referring to the impact of Harvey in the top-producing U.S. state.

In 2016, the United States exported 86 percent of its cotton, 69 percent of which went to Asia, according to the U.S. Department of Agriculture.

Other cotton producers like Brazil and Australia could benefit from lower supplies from the United States, but may find it difficult to match the price offered by India, where a bumper harvest is likely to keep the rates lower.

Traders in India, also the world’s biggest cotton producer, signed their export deals at around 80 cents per lb on a cost and freight basis, nearly 2 cents lower than the supplies from the United States, dealers said.

India could soon sell at lower prices.

Farmers are likely to harvest a record 40 million bales of cotton in the 2017/18 season beginning Oct. 1, 2017, bringing domestic prices down and making exports even more competitive, Patel said.

For the new 2017/18 season, farmers have planted 12.1 million hectares with cotton, up 19 percent from a year earlier, farm ministry data showed.

India harvested 34.5 million bales of cotton in the 2016/17 season.

Favourable crop conditions would help India sell 7.5 million bales of cotton on the world market in 2017/18 against 6 million bales in the previous year, said Nayan Mirani, partner at Khimji Visram & Sons, a leading cotton exporter.

Some traders believe that India’s exports could surpass 8 million bales if China, the world’s biggest cotton consumer, steps up imports in 2017/18.

Beijing, which began selling cotton from its reserves on March 6, had planned to stop the daily auctions at the end of August. But it extended the sales for an additional month after local prices rose amid tighter supply, indicating the need to replenish falling inventories.

A Mumbai-based dealer with a global trading firm company said he had received a flurry of orders in the past few weeks, especially for December quarter shipments. He declined to be identified because he was not authorised to talk to media.

Hobbled by the rising rupee and unattractive global prices, India was struggling to sign export deals until a few weeks ago. But a recent rally in global prices made overseas more sales competitive.

Other than attractive prices, close proximity encouraged most Asian buyers to turn to India. While cargoes from the United States take about 50 days to reach Vietnam, Bangladesh and Pakistan, India can ship its cotton in two weeks.

India’s new season crop will be available to buyers from October, but the supplies from the United States will reach consumers only in January, said Mirani of Khimji Visram, a top exporter.

Current market trends give cotton buyers a chance to look at alternative supplies, said Vu Duc Giang, chairman of Vietnam Textile and Apparel Association.

But forecasts of higher global output will ease concerns over cotton supplies, Giang said.

The U.S. Department of Agriculture this week said U.S. cotton output is seen at 21.76 million bales for 2017/18 compared with 20.55 million bales projected last month.

Source: Reuters